Investing

5: Types of investment account

Opening account before investing is necessary.

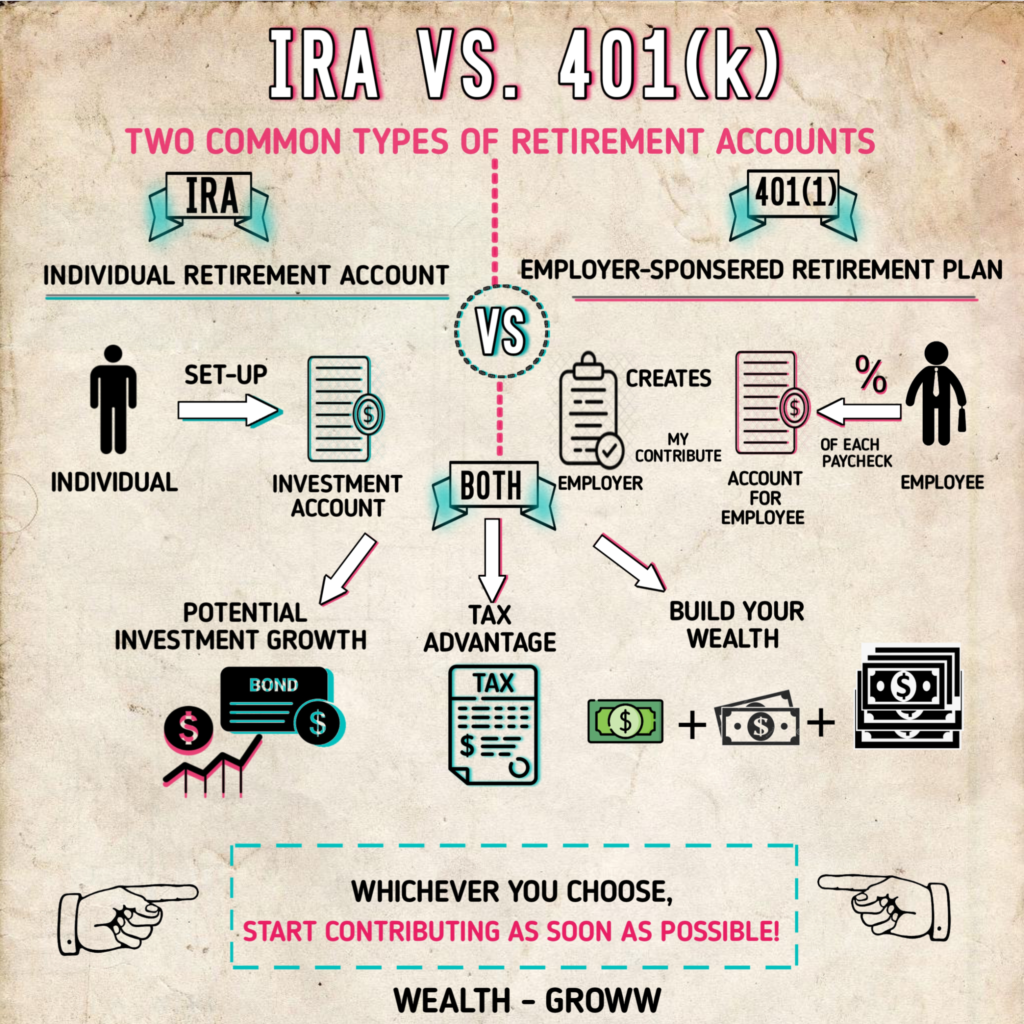

The way investment accounts are treated for tax purposes and the way one can withdraw their money gives the differences between different types of investment accounts. Here are the three main types of accounts:

401(k)

To invest in a 401(k), you have to be eligible for one through your employer. With a 401(k), contributions are taken out of your paycheck before taxes. The other basic features of a 401(k) include:

- No taxes on investment gains or income.

- Withdrawals are taxed.

- Max. annual contribution of $18,500 up to age 50 ($24,500 if you’re 50 or older)

- The age in which penalties on any withdrawal should be taken at the age 59.1/2

- Investment choices may be limited.

Other than tax breaks, for free money a big advantage of 401(K) can be of potential value: Upto a certain amount there are many employers who can match your contribution to dollar for dollar.

Let’s say your company offers a 4% match. In practice it will look like, with a sample of dollar amounts of what you have earned is $50,000 per annum.

If your employer offers a match, it’s crucial for you to contribute enough to at least capture the full match. not going in this way can lead to missing on allot of free dollar money ( which can further raise with compounding).

IRA

Individual retirement account (IRA) can be another way to have savings for retirement. IRAs isn’t linked to the employees and there for one have to set one for oneself.

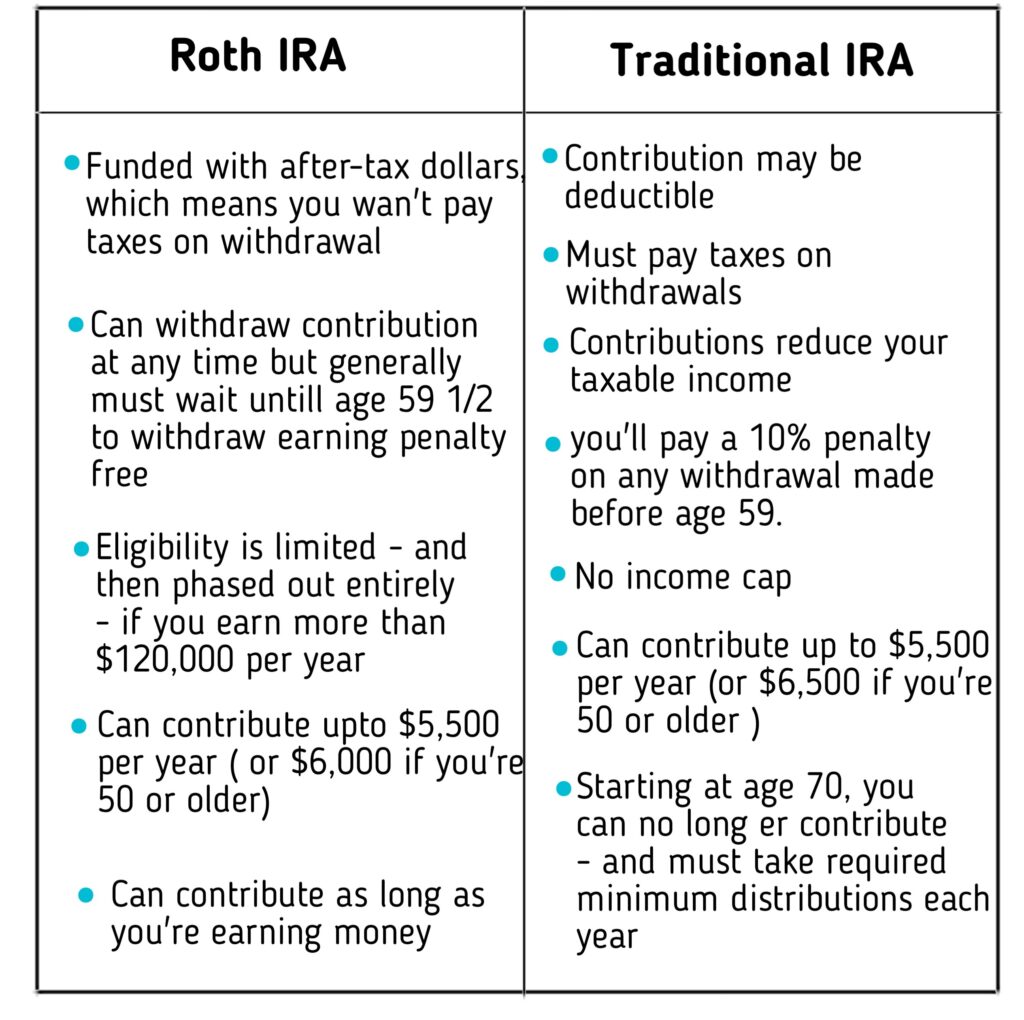

And the first question you’ll face is whether you want a Roth or a traditional IRA.

The key distinction can be:

Confused about which one is good for for you? Few experts recommend on contributing to IRA at the time of early earning( as it will give more earnings).

Taxable brokerage account

An ordinary brokerage account is easy to open but doesn’t come with the tax perks of a retirement account. The pros and cons include:

pros

- No complicated eligibility or withdrawal rules to keep track of

- Easy to fund

- Can withdraw money at any time

- Unlimited investment choices

Cons

- Can owe taxes whenever you sell your investment and gain profit or you can also receive income from the same.

- No employer match

As the tax advantage in retirement account is much wider and that’s why it’s first choice of experts. Via this you can fund your retirement account even before starting your traditional brokerage account.