Savings

One Penny at a Time

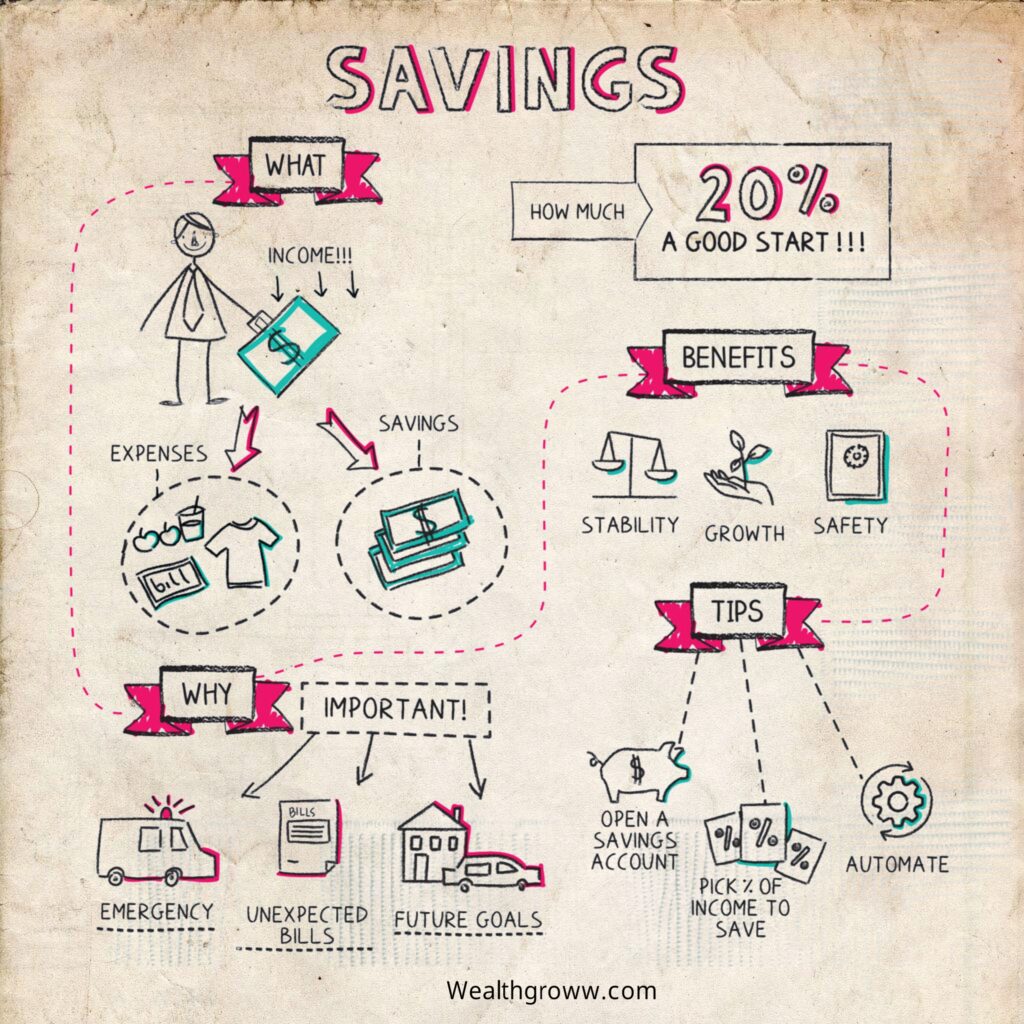

Savings, at its core, is a financial practice that involves setting aside a portion of one’s income rather than spending it all immediately.

It’s a simple yet powerful concept, representing a conscious effort to build a financial cushion for future needs, unexpected expenses, and long-term goals. By consistently saving, individuals not only establish a sense of financial security but also pave the way for achieving aspirations and weathering unforeseen challenges.

In essence, savings is a fundamental tool that empowers individuals to take control of their financial well-being, providing a stable foundation for both present and future financial endeavors.

- These savings are usually kept in a special account, and you can use them for anything you need. However, keep in mind that these accounts might limit you to six withdrawals each month, so they’re not a replacement for your regular checking account.

• Emergency

- This money is set aside specifically for unexpected situations, like sudden medical bills or if you lose your job. Experts suggest saving enough to cover three to six months of living expenses. Just a reminder, buying last-minute Coachella tickets doesn’t count as a financial emergency!

• Retirement

- These savings are for the future, especially for when you retire. They’re usually kept in a special account that helps you save on taxes, like an IRA or 401(k). However, these accounts might have rules about when you can take the money out.

• Dedicated

- This is money you save for a particular long-term goal. It could be for a down payment on a house, buying a new car, or funding your wedding. Having a dedicated fund helps you stay focused on reaching your specific financial goals.

Benefits of savings accounts

Saving money is a smart and beneficial practice. Storing your earned money in a dedicated savings account offers several advantages, including:

• Stability

- Unlike investments that can be unpredictable, savings accounts provide stability. They don’t fluctuate in value and act as a secure place to preserve your hard-earned money.

• Growth

- Your money doesn’t just sit in a savings account; it grows. Interest is earned over time, and this growth compounds as you earn interest on the accumulated amount. Additionally, you can enhance this growth by regularly depositing more money.

• Safety

- The U.S. government, specifically through the FDIC, guarantees the balance in most banks up to $250,000. This assurance means that even in extreme situations, such as a major economic downturn or a scenario reminiscent of “It’s a Wonderful Life,” your money remains secure.

How trimming expenses adds up over time

Saving money involves spending less than you earn. It might be challenging to cut back on indulgences, but the long-term benefits are substantial.

“Do not save what is left after spending, but spend what is left after saving.“

—Warren Buffett

Tips for Saving

Here are some hacks to help turbocharge your savings:

• Track Your Spending:

- Keep a record of how much you spend each month. Many free apps can help you easily monitor your expenses.

• Open a saving account:

- Create a special savings account to keep your savings separate from your spending money. Look for an account with low or no fees and a high interest rate.

• Cutting Cost:

- Distinguish between things you “need” and things you “want.” Identify wants that you could live without. For example, making avocado toast at home is almost as delicious as buying it from a fancy restaurant, and it’s less expensive.

• Choose a Percentage:

- Decide on a specific percentage of each paycheck that you’ll put into savings based on your budget. Any amount is helpful, but aiming for a 20% savings rate is a good goal, as recommended by experts.

• Automate:

- Set up an automatic transfer from your checking account to your savings account. Ensure that a part of your paycheck goes directly into savings as soon as it’s deposited. This helps you save before you have a chance to spend.

• Forget about it:

- Greater risk of poor performancePut your savings account out of your mind and let it grow over time. This approach encourages consistent savings habits without the constant worry or temptation to spend the money you’ve set aside.

In Conclusion

savings are the money you don’t spend, and you store it safely in a bank or another account. Accumulating savings is like constructing a base for your financial security. Developing a habit of spending less than you earn is crucial if you aim to improve your financial well-being. Remember to acknowledge your achievements by patting yourself on the back each time you reach a savings goal. Although saving might be challenging, every step forward is a commendable success!

Fun Facts

- Retail therapy is a genuine phenomenon. Around half of Americans admit that their emotions can lead them to overspend. It’s crucial not to let stress impact your bank account.

- Choosing to pay with cash instead of a card can assist in spending less. Interestingly, physically counting out bills seems to make you more aware of the spending, creating a greater sense of financial responsibility compared to simply swiping a card.

- The financial landscape for many Americans reveals a commonality – most have savings below $1,000. This emphasizes the importance of promoting savings habits and financial planning to enhance overall financial well-being.

Key Takeaways

- Saving money is crucial for creating financial security and getting ready for what lies ahead.

- Putting your money in a savings account has advantages. It can earn interest, keep your money safe, and prevent you from spending it impulsively.

- Cutting back on unnecessary spending, especially on things you want but don’t really need, is a key way to increase your savings. It’s an essential habit to make sure you don’t spend more than you earn.

- Use apps to keep track of how much you spend. It’s a helpful way to stay aware of your expenses and manage your money better.

- Set up automatic transfers from your checking to your savings account. This ensures a portion of your paycheck goes directly to savings, making it easier to save consistently.

- Decide on a specific percentage of your paycheck that you want to save. It could be a small amount, but setting a goal to save around 20% is a good target, according to experts.

- Incorporating these practices—tracking spending, automating transfers, and saving a percentage—can put you on a path toward a savings plan that is not just effective but also sustainable over the long term.

Avoid spending money to save more money.— Wealthgroww