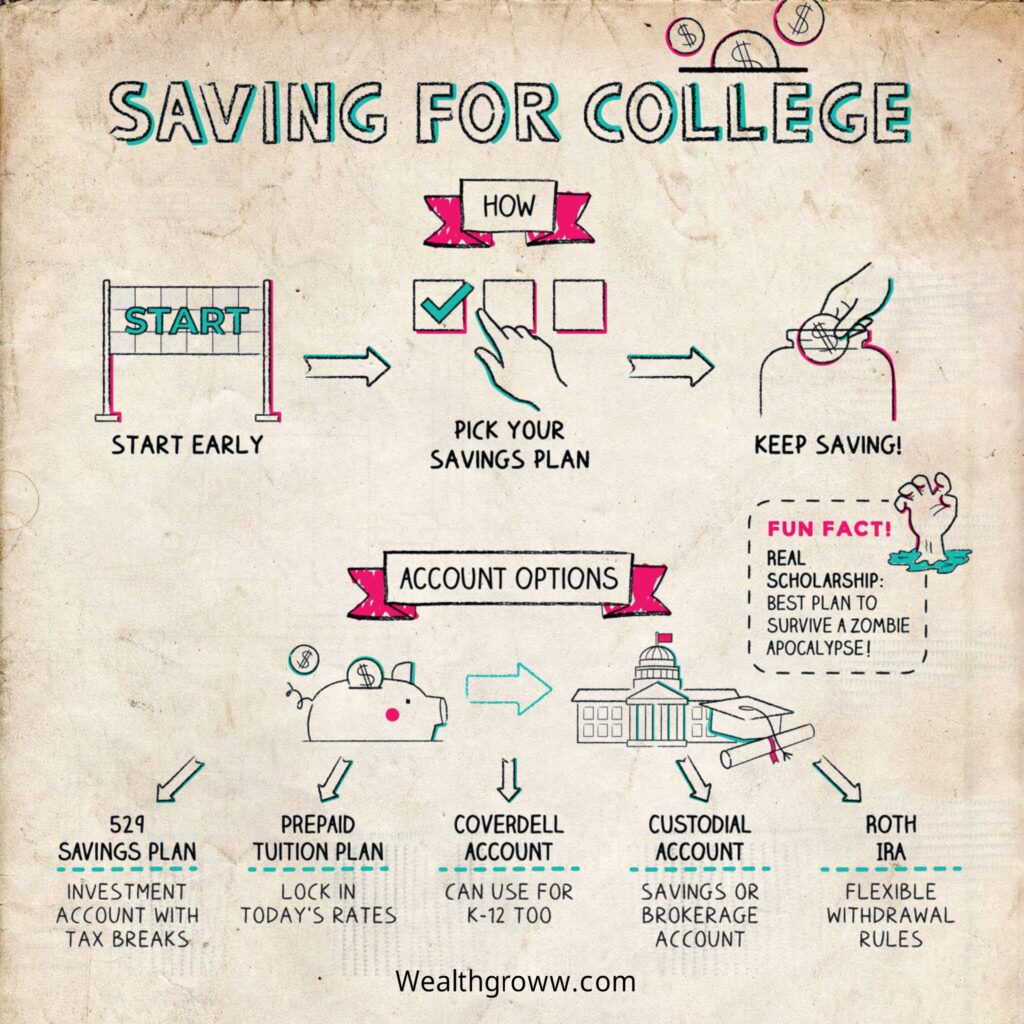

Saving for College

Pay Your Dues

- Avoid hefty loan debt

- Expand your school options

- Save money on taxes

Account types

There are chances that you don’t want to to save anywhere.

But you also need an account where your money can grow ( which will ideally benefit you from tax perks)

Some options include:

- 529 savings plan : state run accounts will let you withdraw for educational expenses.

- Enroll in a Prepaid 529 plan to purchase tuition blocks or full tuition at a state university, securing today’s rates.

- Coverdell education savings account (ESA): it’s an investment account which one can use for their educational purposes.

- Consider a Roth IRA, a retirement account that you may also leverage for educational expenses.

- Explore Custodial accounts (UGMA or UTMA): These are accounts overseen by a custodian until a child reaches the legal age.

Pros and cons

Not every family finds every college savings plan suitable for their needs. They will push you up when the first mail arrives but there available several trade offs.

Conclusion

Setting aside money for college signifies a dedication to your own or a loved one’s pursuit of higher education.

Having a back of money can help you for you College and reducing debts.

There are alot of saving account including 529 plans, coverdell account, and both IRA’s.

Fun facts

- Actual scholarships are available for winners of marbles tournaments, those who triumph in a “cutest couples” contest, and individuals who can submit the most persuasive plan for surviving a zombie apocalypse.

- Waitressing is not the sole option if you seek to self-fund your education. Some students have covered their expenses by selecting a school with a medical center and enrolling in paid clinical trials.

Key takeaways

- Real life scholarships also exists for few like marbles tournament winners or for those who have good plans for surviving a zombie apocalypse.

- Investment accounts, including 529 plans, Roth IRAs, custodial accounts, and Coverdell’s, enable you to save and invest your money, allowing it to grow before you require its use.

- Each savings account type comes with its own advantages and disadvantages, so make sure you comprehend what you’re committing to.

- Starting early, carefully choosing your account type and automating your savings will help in faster progress.

If you found saving money for college challenging, wait until you experience the effort required to gain admission.— wealth groww