Prepaid Card

Top Off

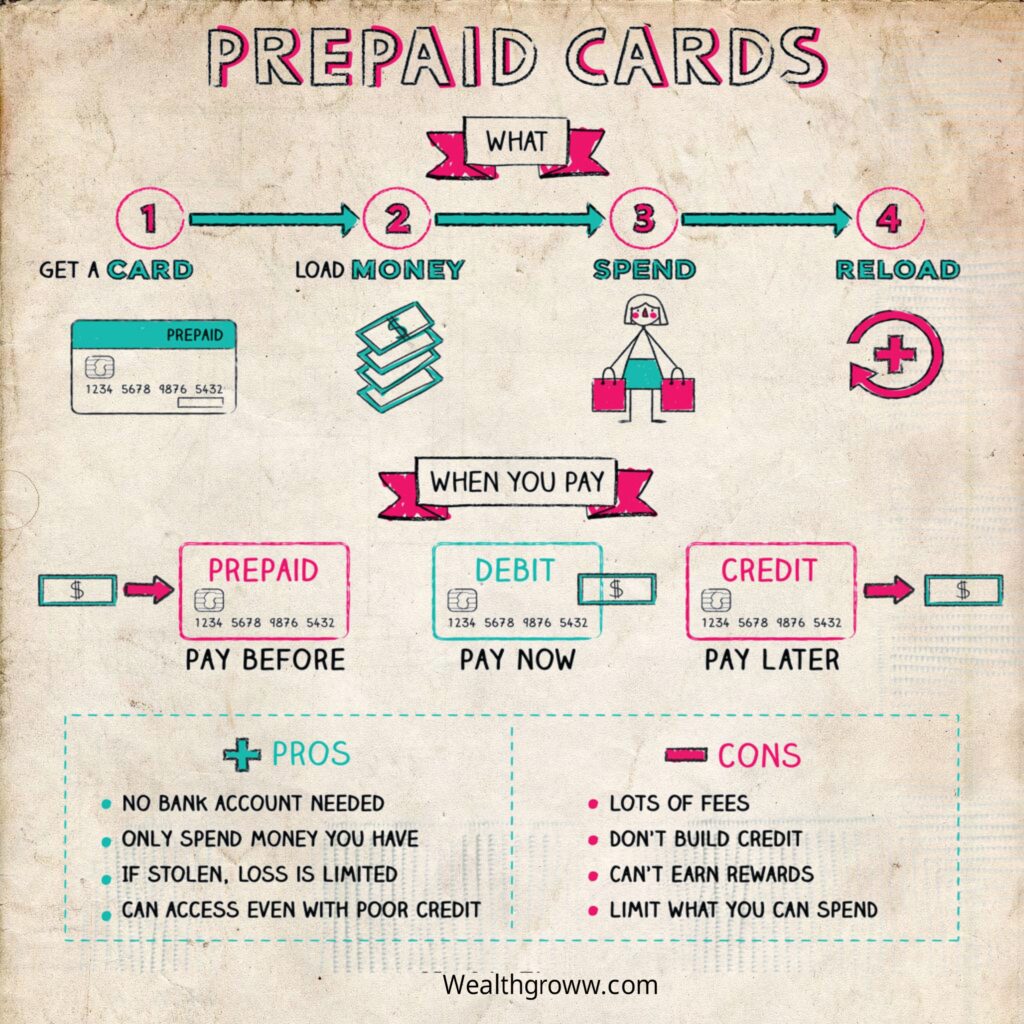

By prepaid card you can spend money on things you had already added to the card. It’s similar to a debit card but doesn’t require a bank account.

How it works

To use prepaid card a little earlier preparation is required.

• Step 1: Buy a prepaid card at a store, over the phone, or online. The card you buy might have a certain amount already loaded onto it or you may need to add money before you can use it.

• Step 2: Use the card for buying stuffs or for cash withdrawal on the basis of limits of your cards.

• Step 3: Reload money onto the card once it’s empty. Depending on your card, you might be able to set up a regular deposit from your paycheck, transfer money from another account, buy a reload card, or add funds where you bought the card.

Fees

Usually prepaid cards carry plenty of fees, though it varies. Fees can include ones charged for:

• Card activation

• Loading money

• ATM use

• Balance inquiries

• Declined transactions

• Inactivity

• Card replacement

• Card cancellation

You must have clarity about any fees charged by credit card.

Who

It is more helpful for those who by any way not able to use traditional debit or credit card. People usually use them if:

- Don’t have a bank account so can’t use a debit card

- Feel uncomfortable carrying cash

- If you have low credit and can’t able to avail credit card.

- To limit your spending don’t use credit card.

- Want to teach kids about spending and budgeting

Pros and cons

Like any financial product, consider the trade-offs before sinking your money into a prepaid card:

Prepaid vs. debit vs. credit cards

For better selection of financial development, the difference between prepaid, credit and debit card is important.

Good to know

Before purchasing credit cards few things should be must known:

- It’s good practice to register your prepaid card so that you’ll have more protection if the card is lost or stolen. Registration might also give your money FDIC insurance (in case the issuer goes out of business).

- Not all cards can be used everywhere.

The so called closed loop cards will limit your spending. - When your card expires, the issuer might charge you for a replacement card with a new expiration date. You might also face a fee if you opt to cash out your money that’s left on the card.

Conclusion

A prepaid card lets you make purchases up to the amount you’ve loaded onto the card. It’s similar to a debit card but doesn’t require a bank account.

Prepaid cards can be used by anyone but they doesn’t help you to repair credit the way credit cards can.

Fun facts

- Around 12 million Americans are using prepaid cards, at least once in a month. That same number of Americans have confessed to keeping a source of income secret from their partners.

- People also use it to limit their spending. About two in five Americans have Balance in their credit card and the average balance more than $ 6000.

Key takeaways

- A prepaid card is a form of payment that requires you to load money onto the card before you can make a purchase.

- People who don’t have a bank account, have bad credit, or need to limit spending often use prepaid cards.

- Prepaid cards typically carries a lot of fees which also includes activation, purchases and ATM uses.

- Prepaid cards differ from credit and debit cards, and while they can be helpful for limiting spending, they have many more fees and usually don’t help build your credit.

Prepaid cards are a great way to say, “Happy birthday. I know nothing about you.” — Wealthgroww