Paying for college

Higher Education, Higher costs

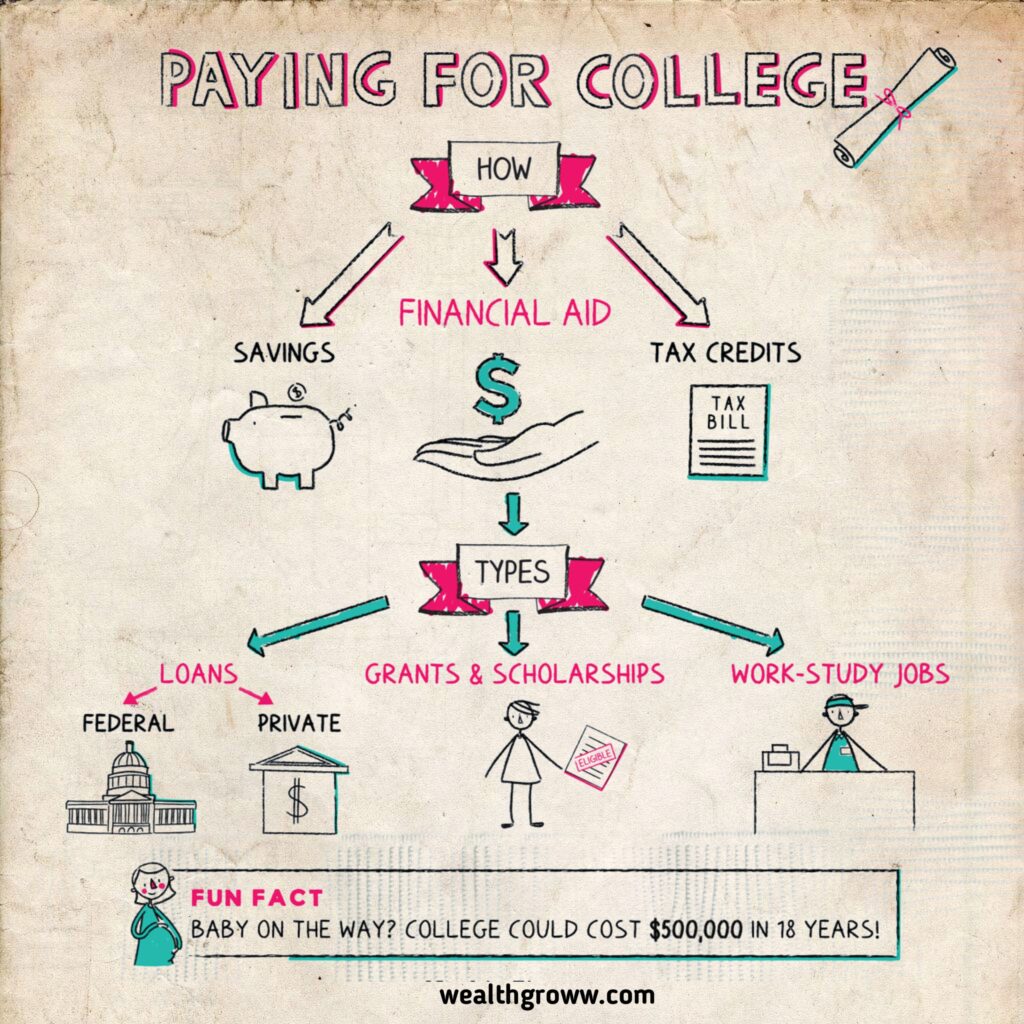

Pursuing a college education can open doors to improved employment opportunities and higher salaries. However, it also comes with a significant price tag, with tuition alone frequently reaching tens of thousands of dollars per year. For paying those bills there are three main resources:

- Savings

- Financial aid

- Tax breaks

Savings

It is advisable for many individuals to initiate savings at the earliest opportunity. This means starting College fund from beginning- even if your kid is in diapers.

The soon you will save the fast your money will grow.

Where you save matters too.There are several offers:

Financial aid

You can start saving even if your child is in your womb you may not have enough cash to pay out of pocket. Financial aid can help cover the difference. There are three main types:

• Scholarships and grants—aka free money!

- Scholarships are usually granted based on merit, which may include achievements in academics, athletics, or even unconventional skills like playing Pokemon (yes, seriously).

- Grants are typically awarded on financial need.

- These things can be offered by college themselves, by any private organizations or various levels of government.

• Work-study jobs

- Students with financial needs could get part time jobs.

- In contrast to other employment opportunities, earnings from work-study programs usually do not negatively impact your eligibility for financial aid.

• Loans—federal and private.

- Federal loans generally provide more favorable terms, including lower interest rates and greater flexibility in repayment options.

- Private loans may come with elevated interest rates and may not provide as much flexibility in payment terms.

How to get aid

For financial aid the prominent way is to file the FAFSA.

Here is the essential information you should be aware of:

What: The Free Application for Federal Student Aid, known as FAFSA.

Why: Completing it serves as an automatic application not only for federal aid but also for school-specific aid, state-level aid, and various other funding sources.

Where: Studentaid.ed.gov/sa/fafsa

When:

- Completing it serves as an automatic application not only for federal aid but also for school-specific aid, state-level aid, and various other funding sources.

- Submitting your application as soon as possible can increase your chances of securing financial aid.

How: To file, you’ll need: - Social Security numbers

- Most recent tax return

- W-2s

- Records for any other income

- Records for bank and investment accounts

FAFSA is not only way, different application process can be followed.

Have a consult with your schools financial aid office for ideas for covering the bases.

Tax breaks

Yet, these options can assist you in reaching your goal. There are typically two primary choices to contemplate, and usually, only one can be utilized at a time:

“An investment in knowledge pays the best interest.“

—Benjamin Franklin

Conclusion

College is unbelievably expensive. But somehow people manage to pay for it, typically with a combination of savings, financial aid, and tax breaks. Initiating early savings for a child’s education, choosing suitable account types, and promptly applying for financial aid can all contribute to covering the expenses. (Interested in maximizing savings for your children’s college education? Don’t have kids.)

Fun facts

- Germany, France, Norway, Finland, Sweden, and Slovenia are some of the countries offering tuition-free college education.

- About two-thirds of recent graduating seniors were leaving college with student loan debt, with an average balance of about $30,000.

- Having a baby soon? A college education could cost $500,000 in 18 years. (Congratulations.)

Key takeaways

- Savings, financial aid and tax breaks can be the best way to pay college.

- Utilizing the appropriate account types and commencing savings as early as possible can enhance your overall savings.

- Financial aid encompasses grants, loans, and work-study opportunities. The most important step you can take to qualify for aid is to fill out the FAFSA.

- Towards the college costs there’s low break in providing big bucks.

But every dollar matters so make benefits of your breaks.

A college education is important so you’ll be able to get a good job to pay for your college education. — wealthgroww