Financial Aid

Lean on me

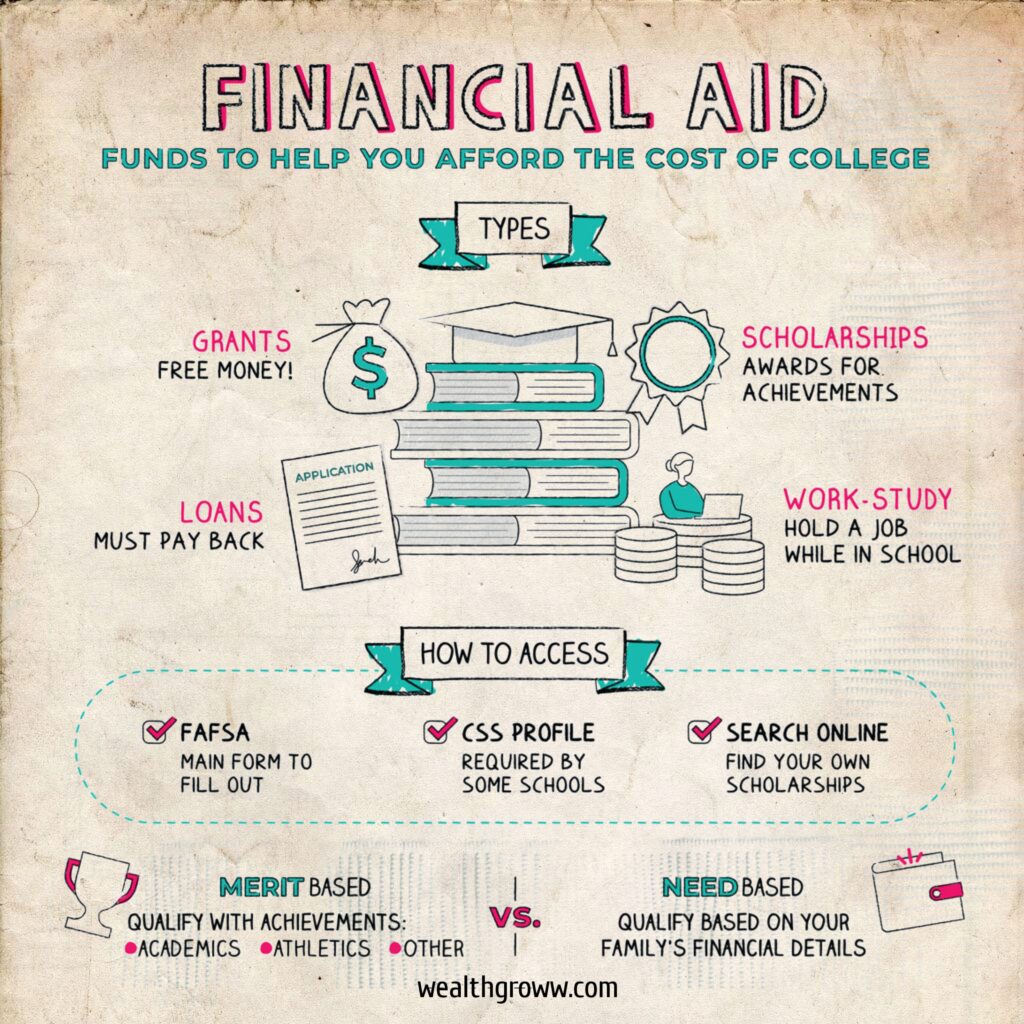

Financial aid can refer to any of a number of types of assistance that help students afford the cost of higher education (whether college or grad school).

Financial aid exists to bridge the financial gap between what you require and what you currently possess.

Types

While various methods exist for covering college expenses (ranging from personal savings to unexpected windfalls or part-time jobs), financial aid primarily takes a few specific forms.

- Merit based: Aid provided for some type of achievement. For example, you might be eligible for merit-based aid if you’re a star athlete, earned perfect grades in high school, or are a gifted painter.

- Need based: it aids the students to get loans. This applies not only to low-income families but to many individuals since college costs are so high.

How to access

You will have to apply for financial aid to qualify and get your money. the process is:

Fill out and submit the FAFSA

(Some schools may also mandate an additional form, known as the CSS Profile.)

↓

Obtain the award letter from the school(s) to which you applied.

↓

Accept, reject, or negotiate the offer

↓

Complete any required paperwork

↓

Receive the money

(it might come to you or go straight to your school)

Scholarships differ in that you typically need to actively seek them out and complete a specific application process on your own.

Good to know

Navigating loans and grant terms can be overwhelming when you’re also navigating classes and schoolwork. Here are some tips to assist you in staying on course:

- You have to resubmit the FAFSA once a year—for every year you’re in school.

- Missing your ceiling deadline guarantees your rejection so you have to take the deadline seriously.

- Know the fine print on all your aid. For example, although many types of loans don’t require any payments until after you’ve graduated, some require you (or your parents) to start making payments while you’re still in school.

Keep in mind that even if you believe you might not be eligible for aid, there’s no downside to submitting an application.

Conclusion

Financial aid will help to bridge gap. Aid can come in a number of different forms, including grants, loans, scholarships, and the federal work-study program. All aid is either merit based—such as based on academic, athletic, or other achievements—or based on financial need.

Fun facts

- If you can dream you can probably get a scholarship.

You could receive $7,500 for being an excellent golf caddy, $3,000 for writing about ghosts or telepathy, or $10,000 for designing your own greeting card. - Number of students opt for financial aid.

Key takeaways

- Financial aid encompasses a variety of financial assistance which will help students.

- You might receive financial aid in the form of grants, loans, work-study jobs, or scholarships.

- Need-based financial aid is available to families who can’t afford the full price of college.

You can qualify for such aids such as FAFSA . - Merit based aid depends on the basis of academic qualification, and other achievements.

- Financial aid can come from the federal government, your state, private lenders, your school, corporations, nonprofits, or community groups.

Regarding “financial aid,” it has a more positive ring than directly saying “please give me money.” — wealthgroww