FAFSA

Aid and Abet

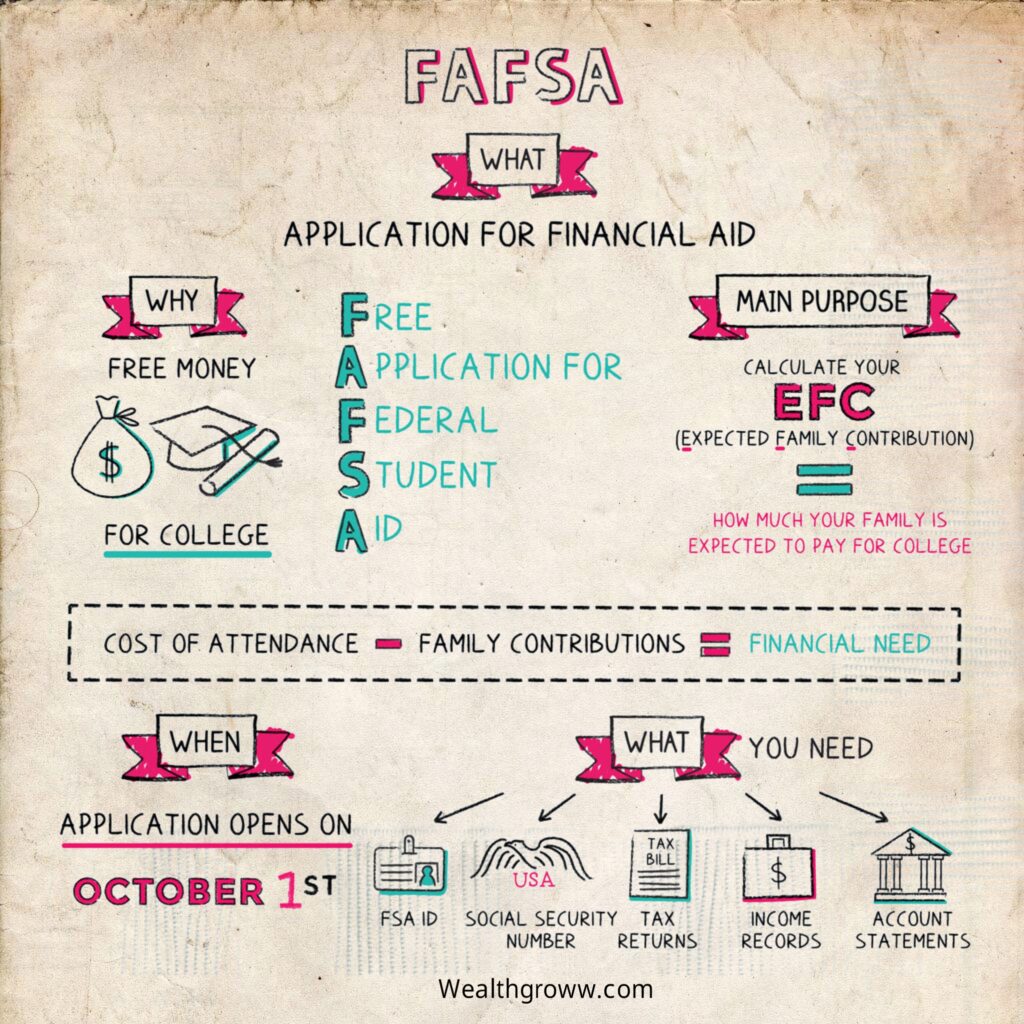

The Free Application for Government Understudy Help, or FAFSA, is a structure that school and graduate understudies finish up yearly as a feature of the monetary guide process.

Why important

More than $120 billion is awarded each year in federal aid. Many states also use your FAFSA information for their own aid. That’s why filling FAFSA every year is important.

How it works

The process looks like this.

Step 1

Apply for a Federal Student Aid ID and password

↓

Step 2

Gather all the documents you’ll need;

wait until filing opens

(Before the relevant school year it’s the October 1.)

↓

Step 3

Fill out the form at the official FAFSA website,

studentaid.ed.gov

↓

Step 4

Review your student aid report.

and your “Expected Family Contribution”

(that is the sum that your family is thought of as ready to pay)

↓

Step 5

Your school (or schools, if you’re applying)

receives your financial information through the FAFSA

↓

Step 6

Your everyday schedule convey their monetary guide letters,

often in March or April

What you need

For filling out form, things you need;

- Your Social Security number

- Your recent tax returns(or your parents’ returns)

- Any bank or brokerage statements

- Records for any other types of income

How used

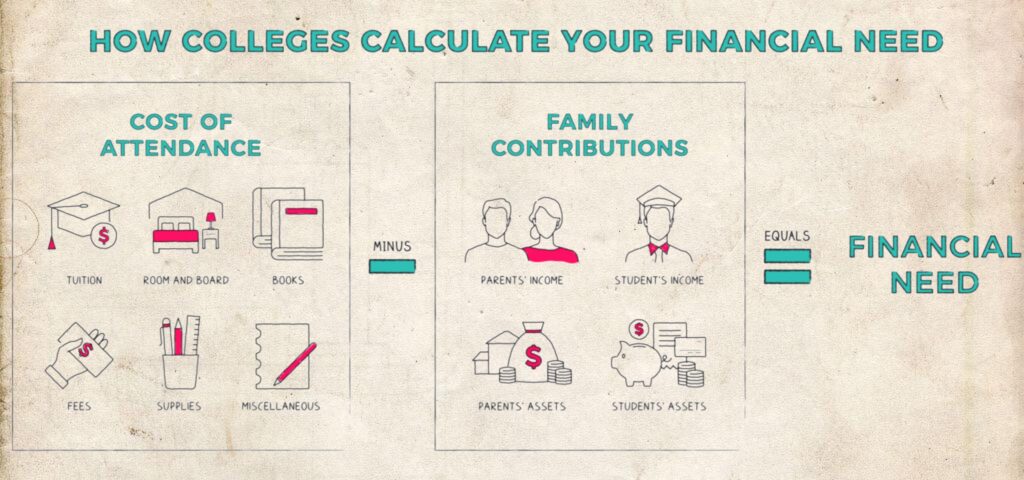

The schools use your FAFSA information to see your financial need. They do this by taking away your Normal Family Commitment from the expense of participation.

- Tuition

- Room and board

- Books

- Any extra fees

- Supplies and miscellaneous expenses

- Your family’s income (including any jobs you have)

- Your family’s assets

- Any government benefits your family receives

- Family size

- Whether you have other relatives in school

Tips

Ready to start? Keep this things in mind:

- Give yourself some time – filling FAFSA will take around an hour only.

- Be precise – to avoid delays fill the form right the first time.

Even if you are not qualified then also you can. - fill it-FAFSA will help non need based aid as well.

- Fill it out early—A few schools give out help on a moving premise. You might finish it up before your acknowledgment letter shows up.

- Fill it out each year—Sadly, FAFSA isn’t limited time offer; you really want to finish it up for every year you’re in school. “It’s one thing for financial aid available to attend college.

“It’s one thing to make financial aid available to students so they can attend college. It’s something else to configuration shapes that understudies can really finish up.”

—Cass Sunstein

Conclusion

Form for federal financial aid to pay for college is free application for FAFSA.

Some schools and states also use the FAFSA to determine eligibility for grants, scholarships, and other need-based and non-need-based aid. You need to fill out the FAFSA each year you’re enrolled in college or grad school.

Fun facts

- Sometimes people by mistake put their information instead of their children’s.

- It’s known as the “Free” application for help since it’s free, however some copycat private sites might in any case attempt to inspire you to record with them for a charge. (Here’s a clue: You never need to enter charge card data to finish up the genuine FAFSA.)

Key takeaways

- FAFSA form will access financial aid for college.

- It requires reporting your income (and your family’s, if needed), assets, other finances, and personal information.

- FAFSA be like ” we notice that your parents got extra guacamole at lunch. including need-based and merit-based aid, and federal, state, and school-specific aid.

FAFSA be like “We see your folks got additional guacamole at lunch . . . you must not need any aid.” — Wealth groww