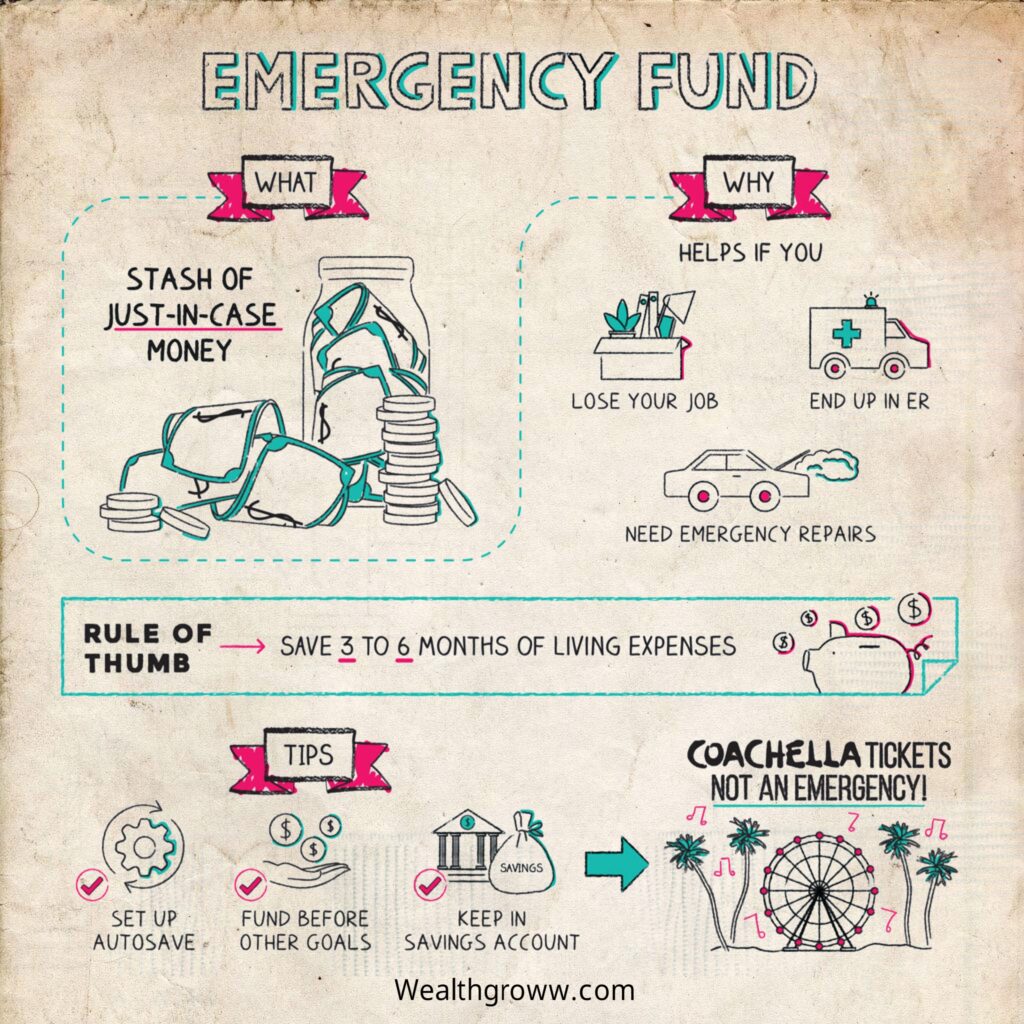

Emergency fund

Cash Cushion

How to build

Experts typically recommend that you keep three to six months of living expenses in your emergency fund (an amount that’s probably less than three to six months of your income).

However, you can potentially adjust that number up or down depending on certain factors:

Getting started

Initiating an emergency fund is pretty painless process.

But keeping it going (and protected!) is where willpower comes in. Here’s how:

Step 1

Figure out your funds.

↓

Step 2

Establish a distinct savings or another type of account.

↓

Step 3

Pick a weekly or monthly savings goal

↓

Step 4

Keep going! Slow and steady wins the race

↓

Step 5

Check in and reevaluate your emergency fund

anytime you have a major life change

(like a raise or an addition to your family)

If there’s any unpredictable use of emergency fund reup it as fast as you can.

Don’t be a one-and-done saver!

How to save more

When you first figure out how much you need in your emergency fund, it can seem like an overwhelming amount. You don’t have to achieve your goal overnight (and realistically, you won’t), but there are some proven methods to steadily make progress:

- Direct your tax refund, bonus, or any unexpected windfalls straight into your emergency fund.

- Start using a budget

- Cut down on unnecessary expenses

- Reshop your insurance, and put the savings into your fund

- Cut off on your subscription. (Cancel payments for a gym you don’t attend or streaming services you don’t use!)

- Making it a priority. As per experts one should build up their emergency fund before tackling other goals and savings for retirement.

- Establishing automatic transfers from your checking account to your emergency fund until it reaches full funding.

- Maintaining it in a savings account, where it has the opportunity to accrue interest.

When to use

Last-minute Coachella tickets might seem urgent, but unfortunately, they don’t qualify. Refrain from tapping into your emergency fund unless the expense you’re dealing with is genuinely an emergency.

Don’t use emergency funds for predictable expenses. This will help you when unexpected events happens. If you anticipate your car reaching the end of its lifespan soon, create a dedicated fund for a new car. This way, you won’t have to deplete your emergency savings when the need arises.

Conclusion

Usually experts recommend for spending 3-6 months expenses aside for this fund which you can adjust as per your lifestyle and other factors. Your emergency fund should be easy to access but not so easy that you’re tempted to spend it.

Fun facts

- About two in five adults don’t have the cash to cover a $400 unexpected bill.

- Home repairs and car repairs etc. stuffs put people in dillema which results in spending emergency fund.

Key takeaways

- Emergency fund is like saving of funds for emergency purposes.

- Try atleast of 3-6 months expenses in keeping in emergency funds.

- Hitting such saving goal will be a challenge therefore you should try to priorities your emergency fund. Identify expenses to trim down while you concentrate on achieving full funding.

- And it should be held at a place which is safe like saving account.

Emergency funds also helps in the case of unexpected unemployment.

As it’s sad prevention is better than cure.

— wealth groww