Debt

It All Adds Up

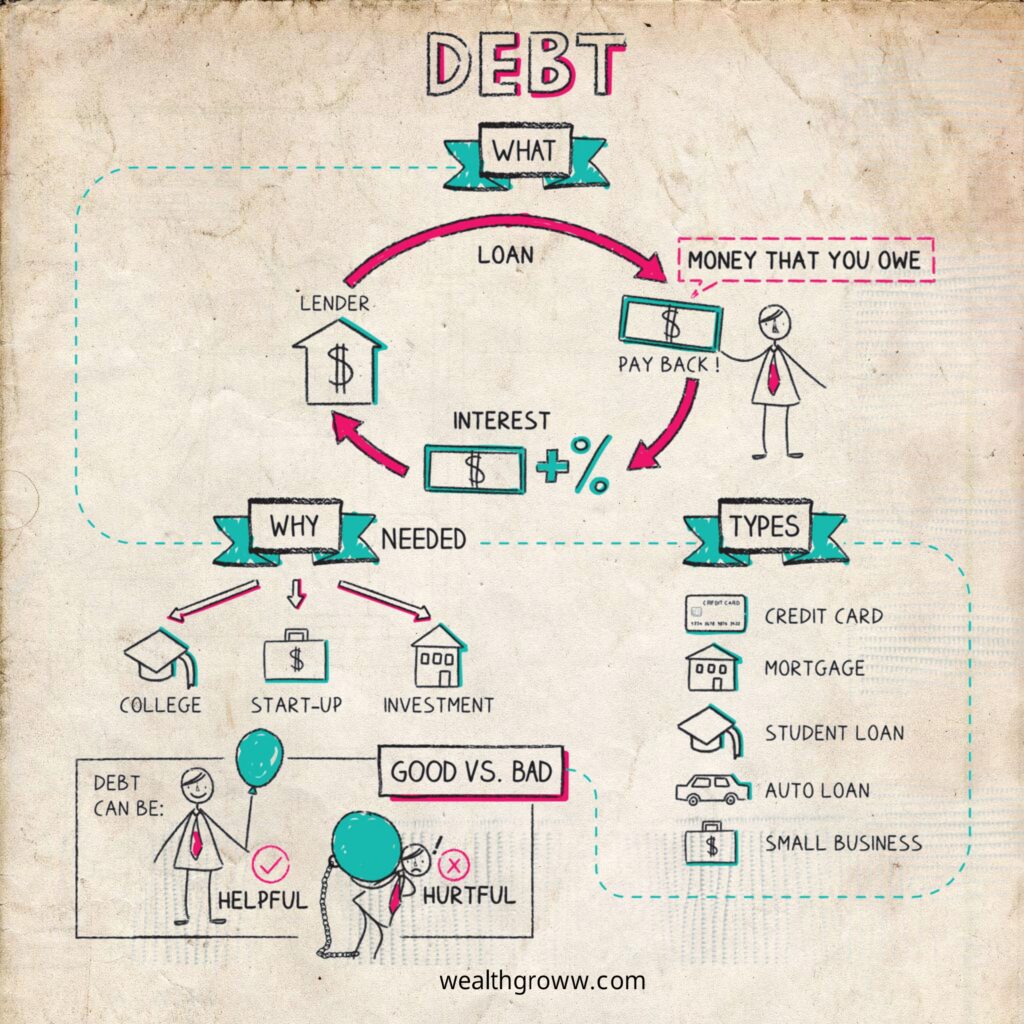

Debt is a money that you owe to someone i.e, other’s belonging.

When you borrow you in a way agree to return it back in a definite time called the loans term. And you usually have to pay interest in addition to the original amount you borrowed.

Types

You may use several types of debt at different points in your life. Some common types includes:

- Credit card—Any time you pay with a credit card, you are borrowing money. Paying down your balance means paying off the debts.

- Mortgage—loan for real estate. A typical mortgage is paid back over a 15- or 30-year period.

- Student loan—for fee payments.

- Auto loan—An auto loan can help you buy a car.

- Small business—Companies borrow money too. Small-business loans can help new companies get off the ground.

You can also categorize debt as secured or unsecured. Secured debt means you have agreed to use some asset—such as your home or car—as collateral for the loan. If you don’t repay your debt in a timely manner, the lender can take that asset from you and sell it to make up for any money you still owe.

There is no collateral when it comes to unsecured debts, but there are consequences if you don’t pay what you owe: the could sue you.

“If you think nobody cares if you’re alive, try missing a couple of car payments.“

—Earl Wilson

Good debt, bad debt

You should be careful about borrowing money. (as long as you can afford to pay it back on time).

Undeniably, enterprises are often plagued with debts so that they can do things like produce new products, expand to other areas or even adopt modern technologies. There is a reason behind all these undertakings, which is meant to make profits greater in future.

In most cases, whether a loan is “good” or “bad” is a matter of the interest rate and if you are borrowing to make an intelligent investment.

- Interest rate—This number tells you how much it costs to borrow the principal amount.

- Annual percentage rate (APR)—An annual figure that includes interest but also other costs or fees associated with your loan.

Conclusion

In life there are number of chances for you to take debts. In some cases, taking on debt can benefit you in the long run. Be careful, however, about taking on more than you can handle. Make sure while shopping to have a realistic plan for it.

Fun facts

- American household have capacity of carrying more than $13 trillion in debt including $9 trillion in mortgage more than 1.5 trillion in student loans and $1.2 trillion in auto loans.

- Twelve years is how long it would take for the average U.S. household that carries credit card debt to pay off its balance by making only the minimum payments.

- The last time the U.S. government did not have a national debt was in 1835. This debt free period went on for only one year.

Key takeaways

- Debt is borrowed money that must be repaid, usually with interest.

- Chances are that at some point in your life you’ll take on debt, such as student loans, credit card debt, or a mortgage.

- Whether debt is good or bad it depends on whether the interest rate is high or low and good investment.

Not all debt is bad. Some is just misunderstood. — wealthgroww