College

Higher ed can get you ahead, but the price tag can be significant. We’ll help you learn to make college more affordable.

Keep the change

Like other good habits saving money is also an easy task. Once you have set up yourself in an spending routine it happens within expenses.

Lean on me

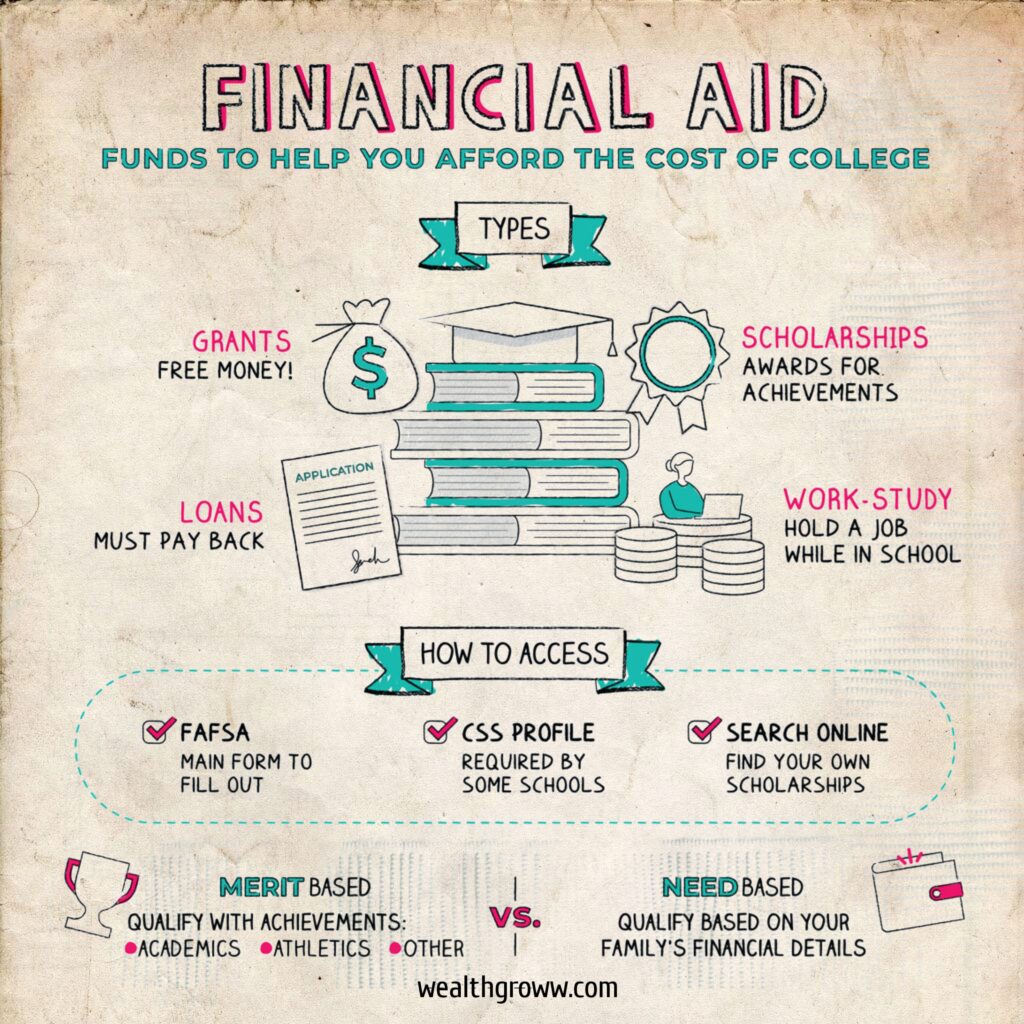

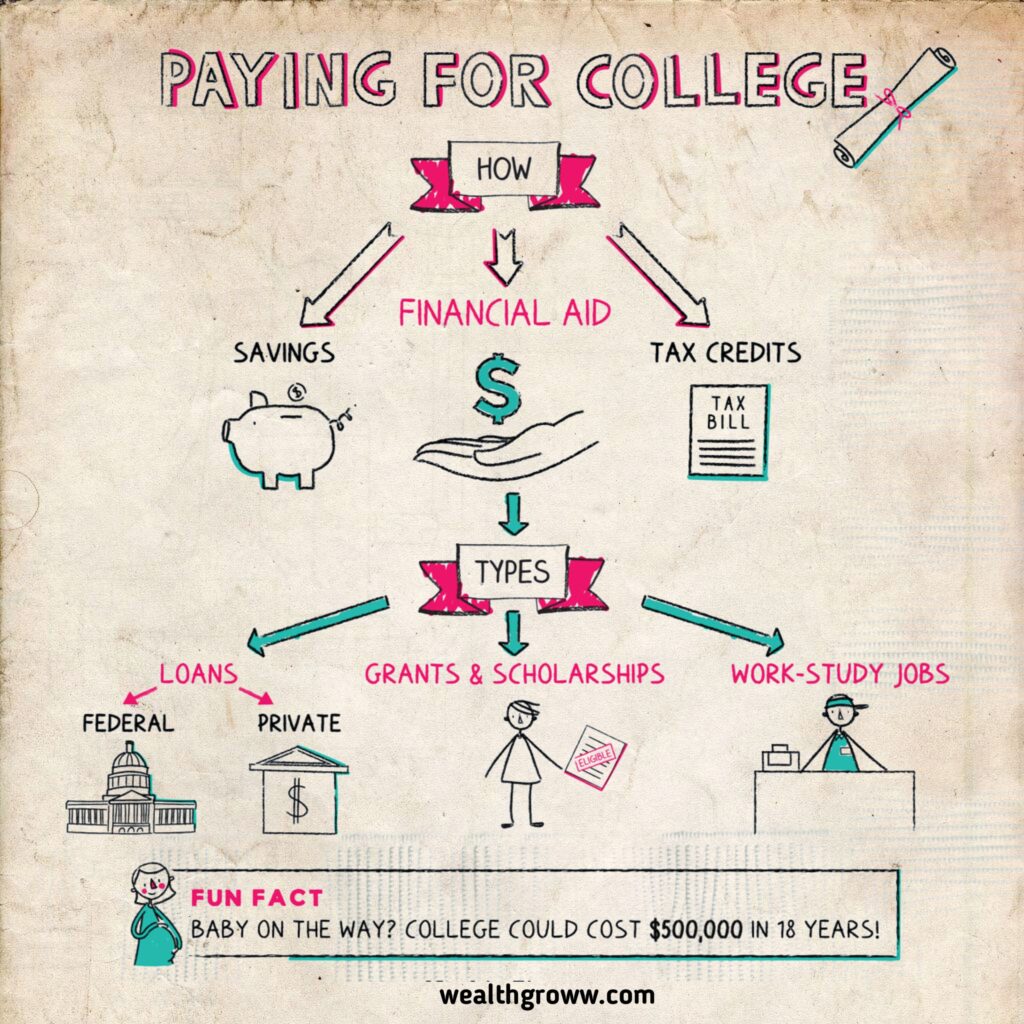

Financial aid can refer to any of a number of types of assistance that help students afford the cost of higher education (whether college or grad school).

Higher Ed, Higher Returns

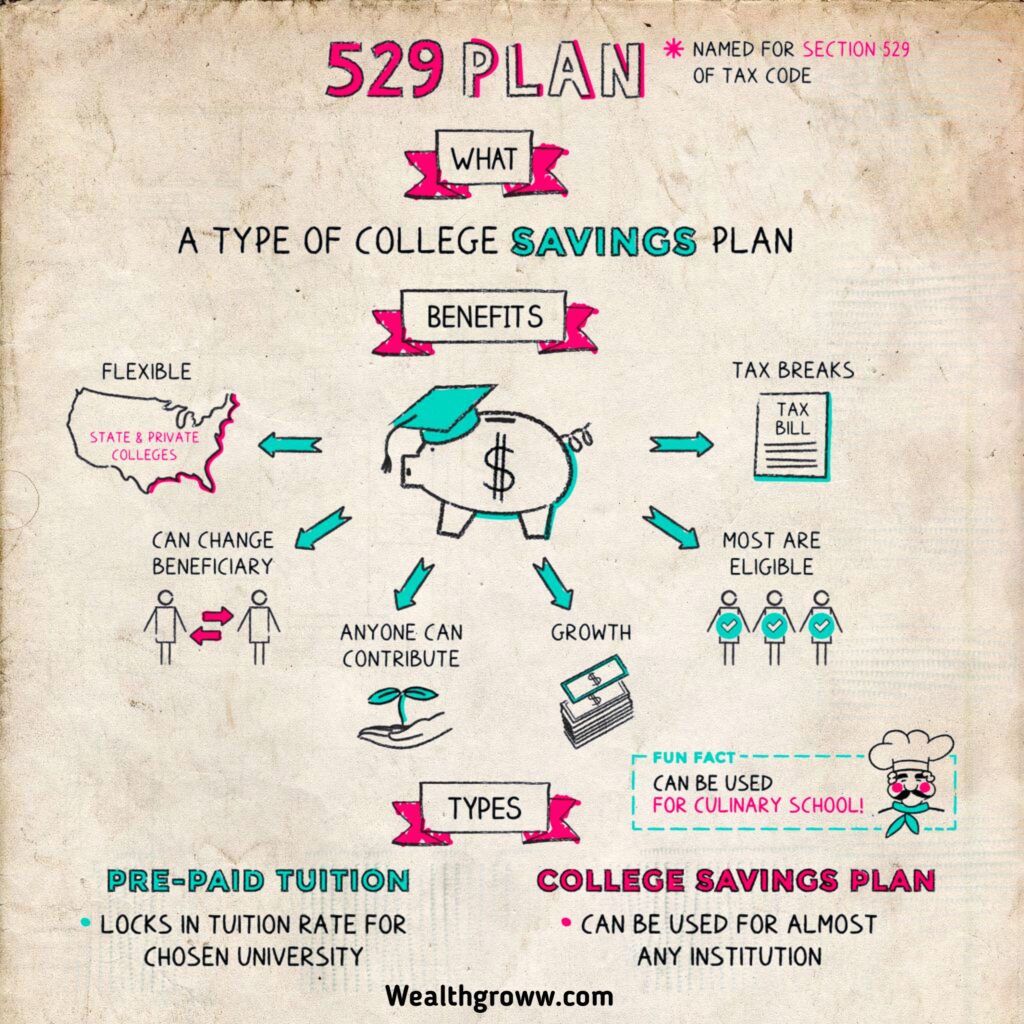

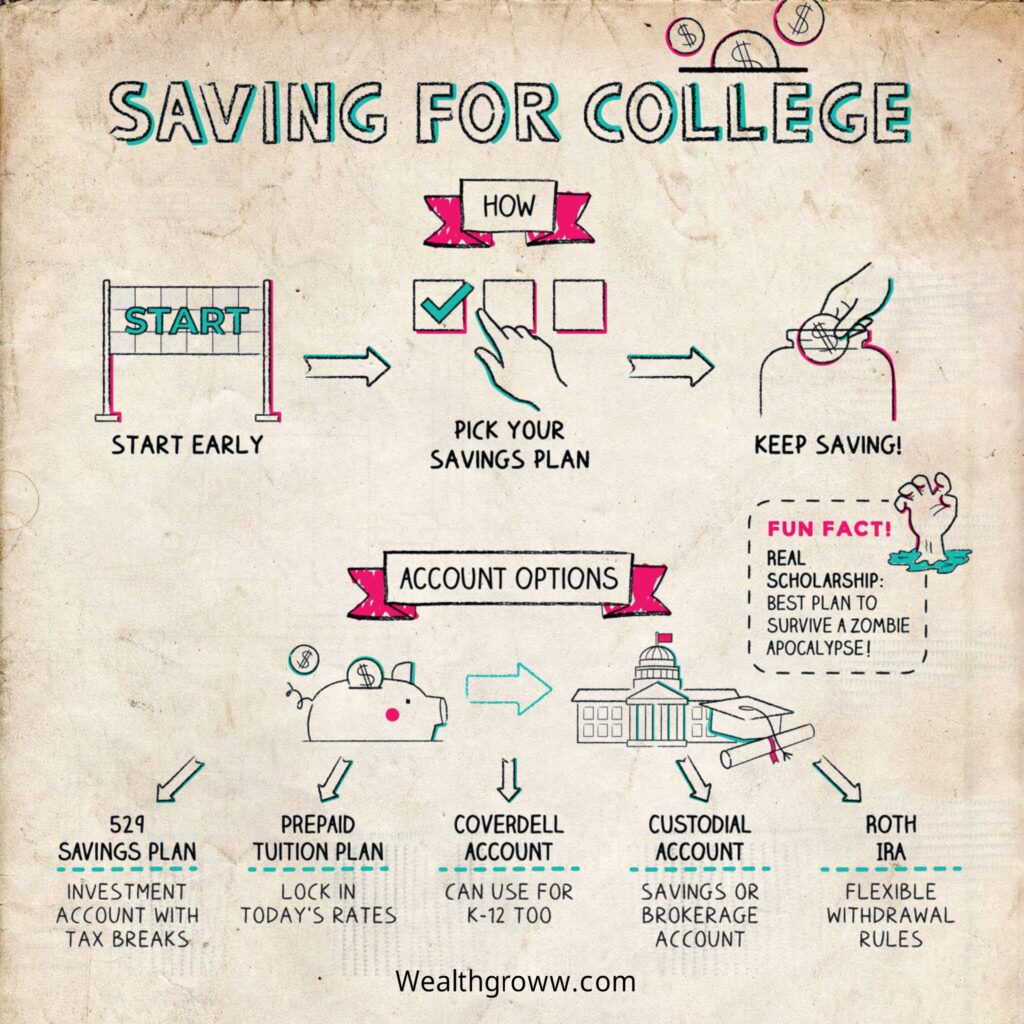

529 plan is a state government or education institution sponsored tax advantaged college saving account. The plans are kind of like 401(k)s for college funds.

It All Adds Up

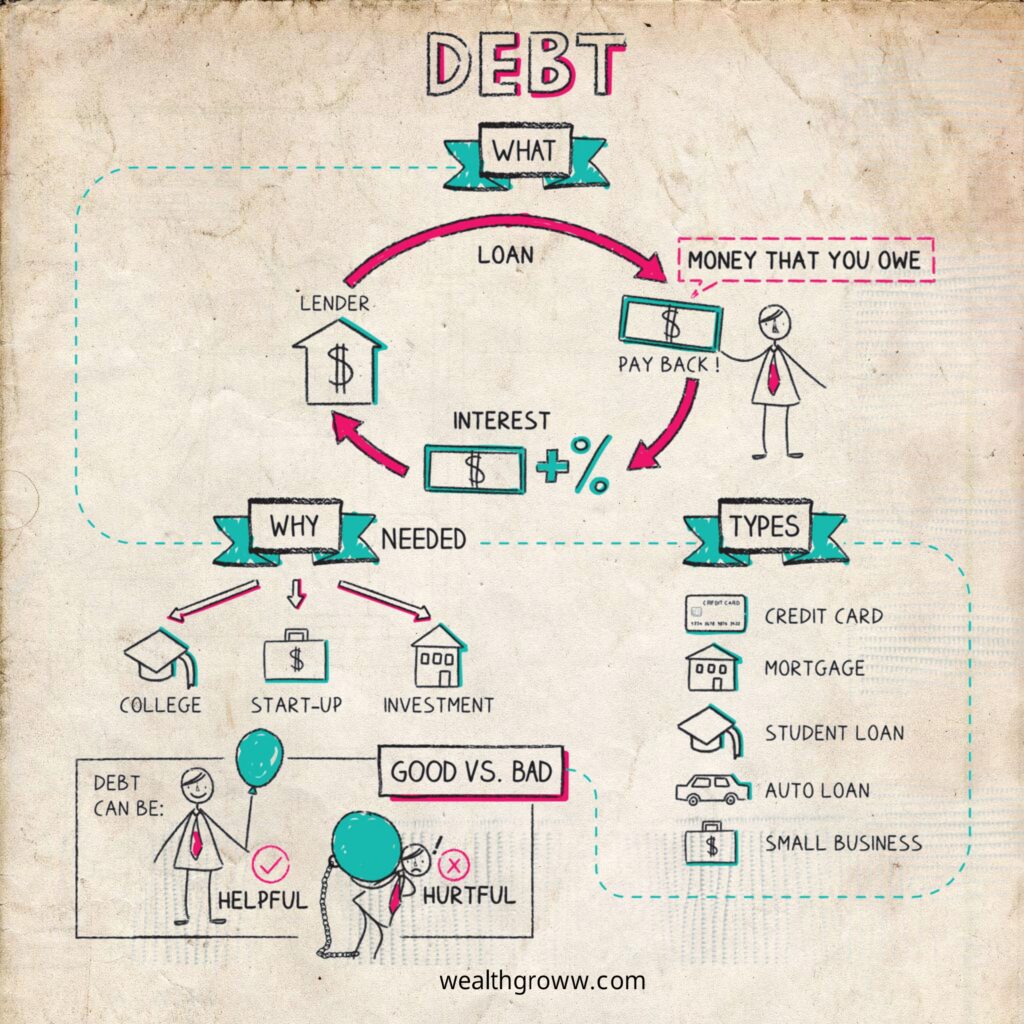

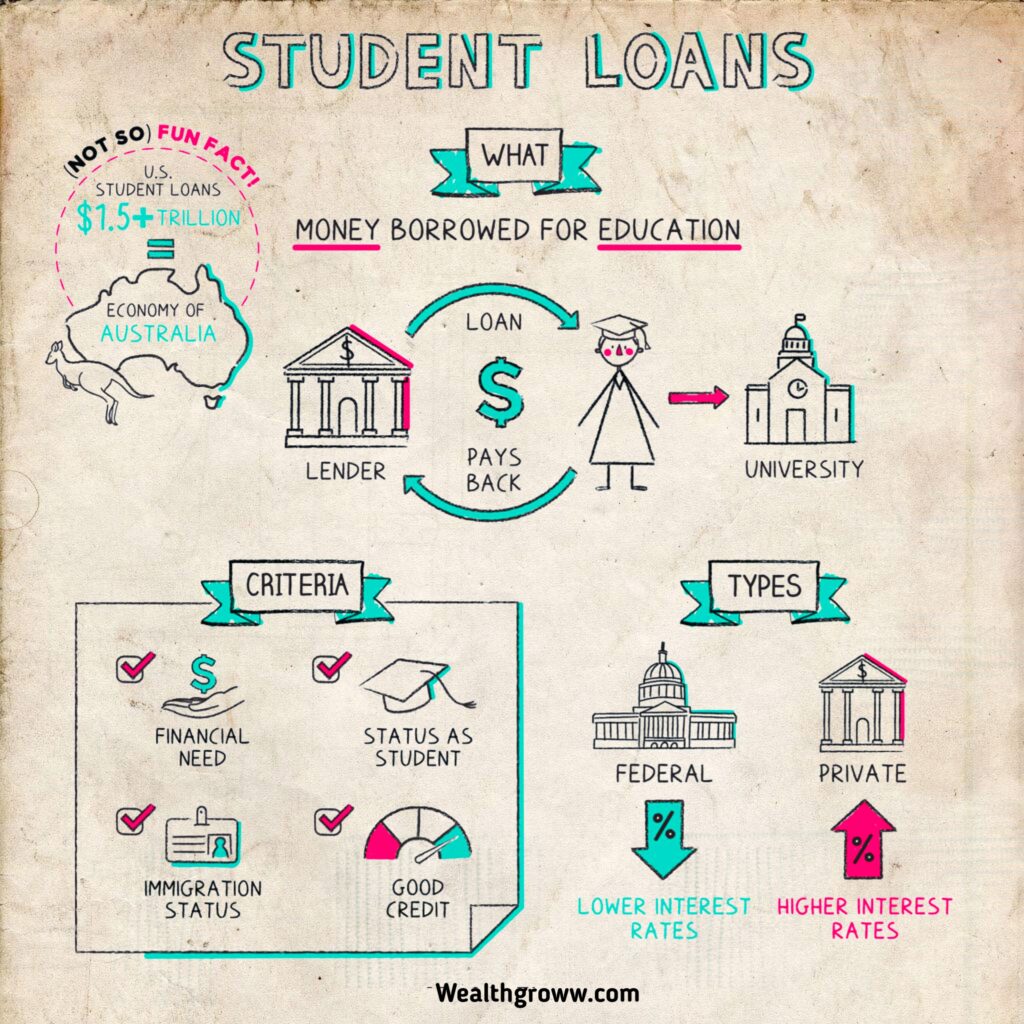

Debt is a money that you owe to someone i.e, other’s belonging. When you borrow you in a way agree to return it back in a definite time called the loans term.

Nickels and Dimes

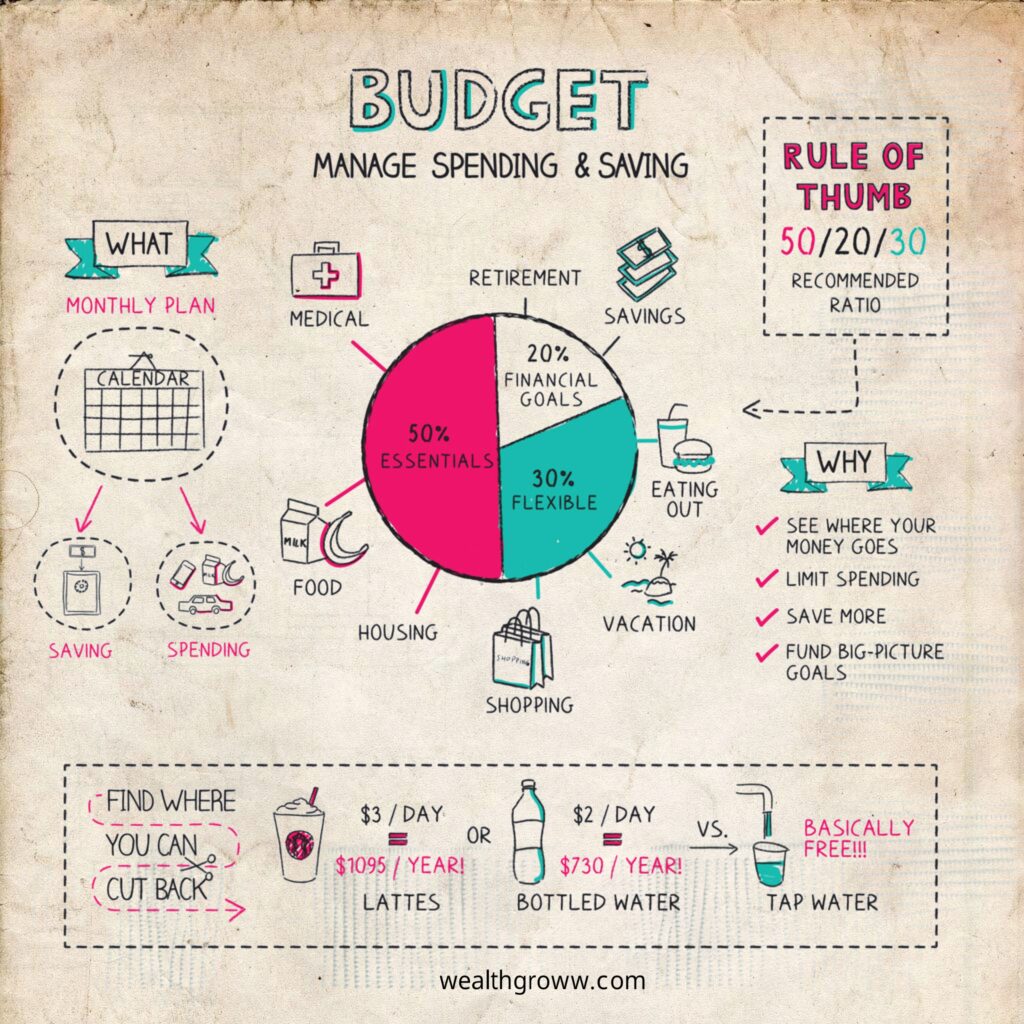

Budget is a management plan which you can use to manage your spending and saving. When you follow a budget, you set limits on where your money goes.

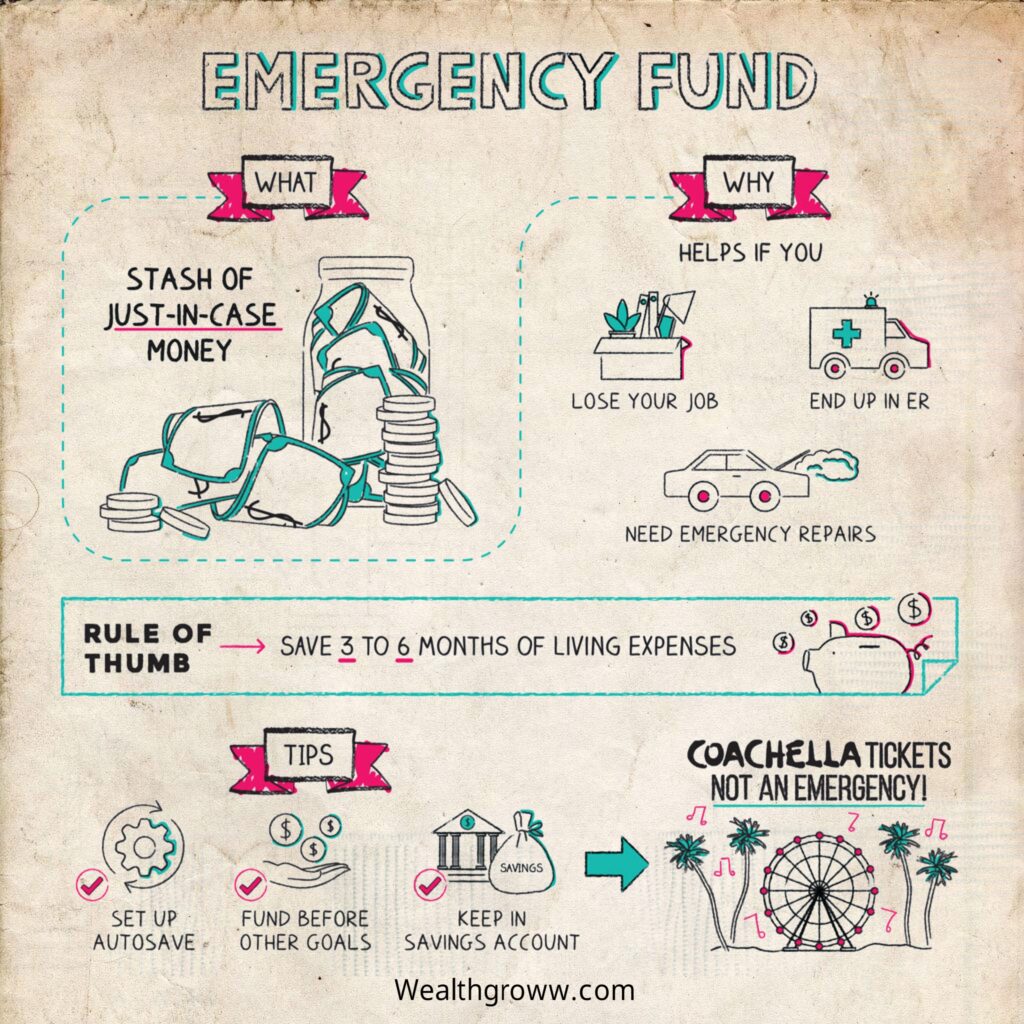

Cash cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital piece of your financial safety net.

Pay Your Dues

Your college savings includes expenses for future education. It means making a dedicated investment in your (or a child’s or other loved one’s) future higher education.

Higher Education, Higher Costs

Going to college can lead to better jobs and bigger paychecks. But it comes at a high cost, with tuition alone often costing tens of thousands of dollars a year.

Old college try

Student loan have a number of varieties and it’s not necessary to pay it for education only. Well the name imply that it is for students…

Aid and Abet

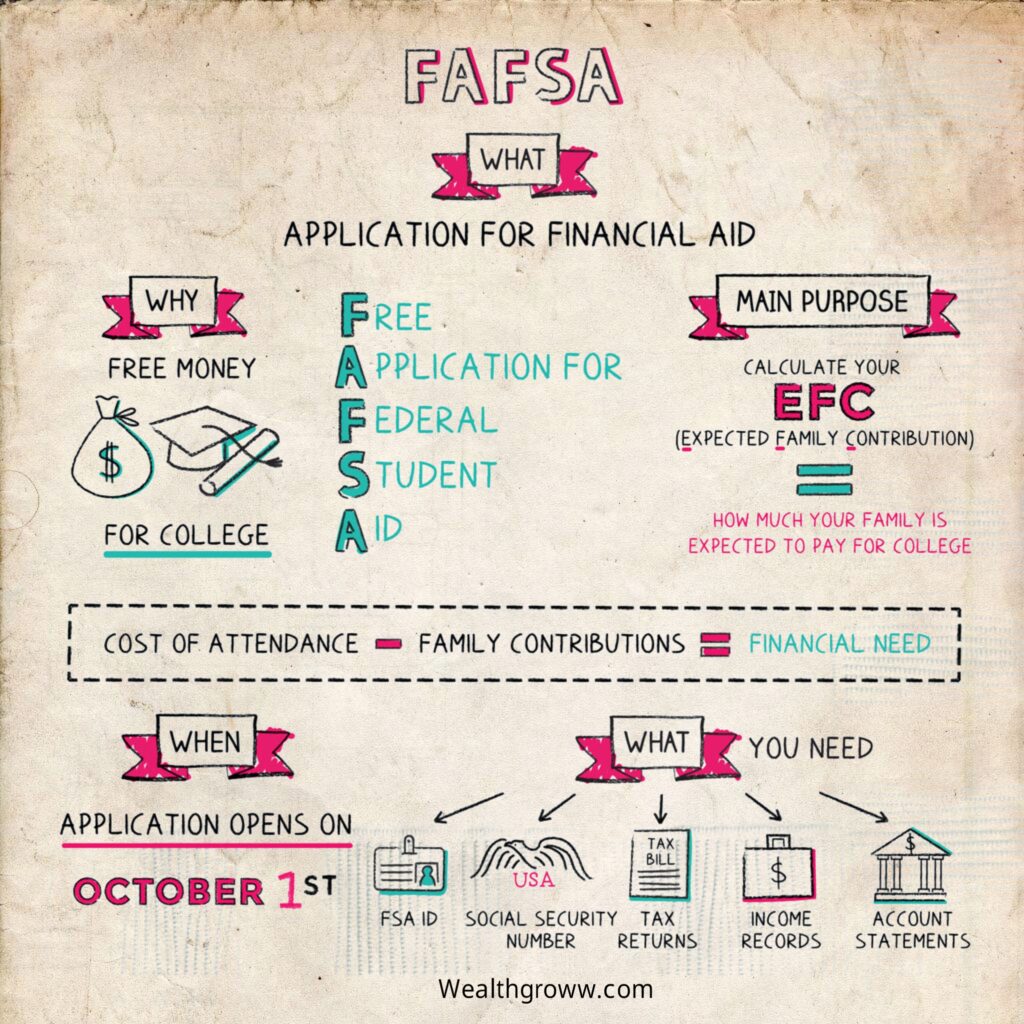

The Free Application for Federal Student Aid, or FAFSA, is a form that college and grad students fill out annually as part of the financial aid process.

Top Off

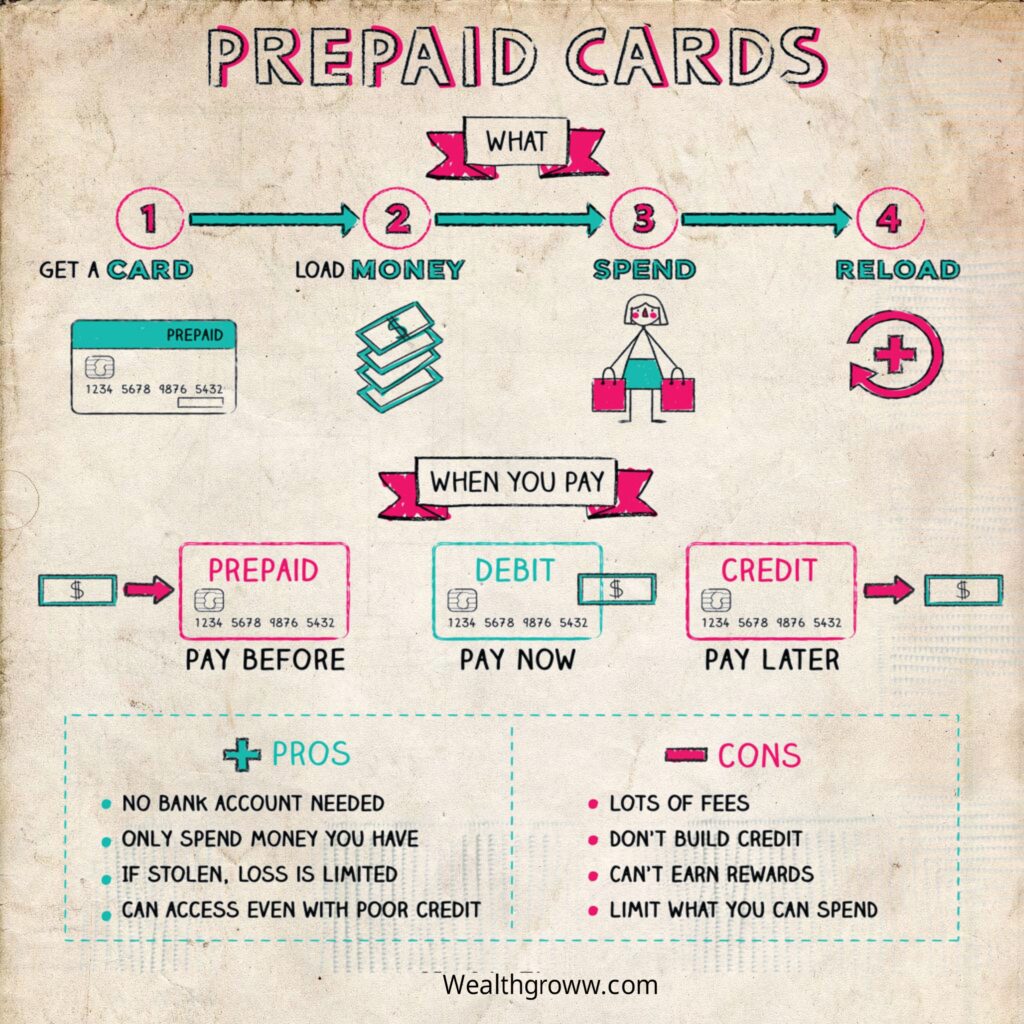

By prepaid card you can spend money on things you had already added to the card. It’s similar to a debit card but doesn’t require a bank account.

One Penny at a Time

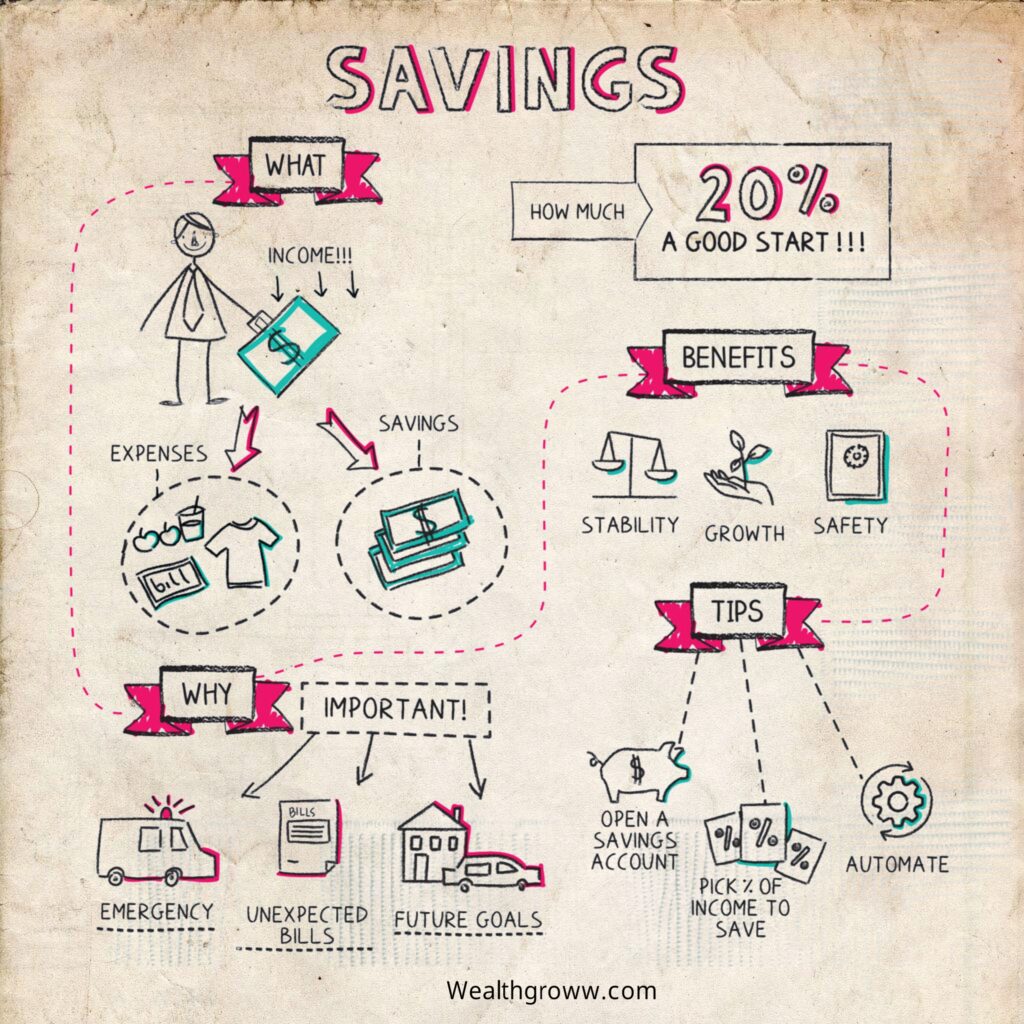

Savings, at its core, is a financial practice that involves setting aside a portion of one’s income rather than spending it all immediately.