ETFs

Jacks-of-All-Trades

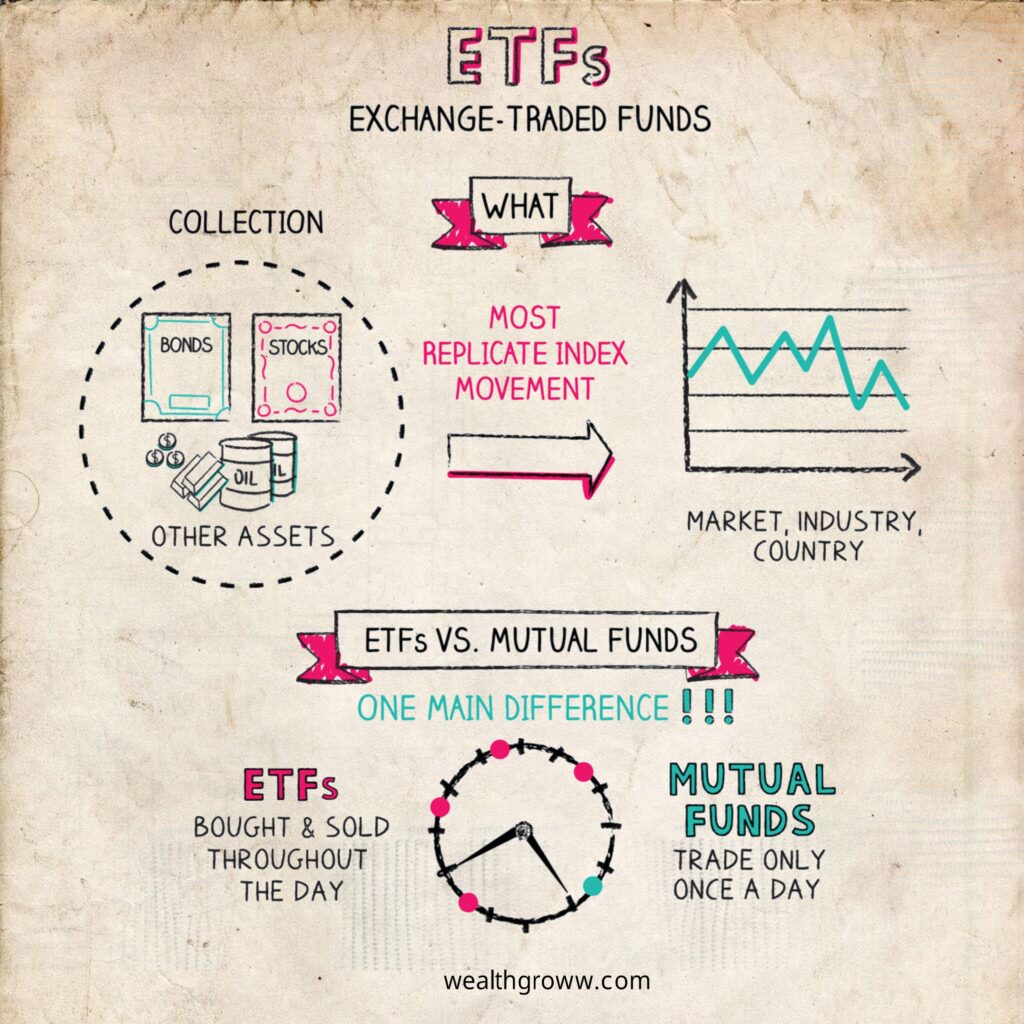

Exchange traded funds are also investment similar to mutual fund.

Like shared reserves, ETFs are expertly overseen crates of speculations that pool many financial backers’ cash together. Additionally like shared reserves, ETFs can be incredible devices for assembling a wide, very much broadened portfolio.

ETFs vs. mutual funds

Though there are some differences. Here are the important distinctions:

Indexed vs. actively managed

ETFs are mostly ‘indexed’ i.e, they opt for comparison with specific index for example Dow Jones. The asset does this by purchasing the file’s all’s stocks and bonds (or possibly a decent example of them) and holding them in similar extents as the list.

Other ETFs are actively managed. Their venture supervisors attempt to beat the exhibition of a market list by picking explicit speculations that they think will have better than expected returns.

It sounds like an amazing way of building money, but sometimes it also have downfalls as well considering:

- Higher expenses

- Greater risk of poor performance

- More tax bills along the way

- Specific sectors or industries (e.g., technology, utilities)

- A solitary far off country (e.g., Japan’s Nikkei, the UK’s FTSE)

- One or more than that commodities(like gold and oil)

- Currencies (e.g., euro, Canadian dollar)

- Real estate (e.g., warehouses, shopping centers, mortgages)

Why popular

Since few years ETFs became famous as,.

• Index investing is popular.

- Evidences shows that on an average investors performs better with index funds with an aim to match markets return than they do with actively managed funds. which expect to beat the market’s profits.

• Fees can be even lower than with mutual funds.

- You can buy indexed mutual funds but index ETFs will have low fees and fees and returns are reciprocal.

• Low initial investment.

- You can start monetary preparation at the expense of just a single deal.

(For Mutual fund thousands of dollars can be a minimum initial investment.)

• You can invest in almost anything with them.

- Similarly likewise with shared reserves, ETFs can hold conventional stocks and bonds. In any case, you can likewise utilize them to put resources into things that are further away from home.

For example: ETFs holding physical gold, which tracks the day to day oil prices.

Conclusion

Exchange traded fund can be called as collection bonds and stocks into a single fund.

You can trade shares of ETFs on stock exchange. Despite the fact that they’re basically the same as shared reserves, not at all like common assets, you can exchange ETFs all through the exchanging day.

Fun facts

- The SPDR Gold Offers ETF holds around 70,000 bars of gold (each weighing 400 ounces) in a HSBC vault in London. Once in a year they hire a firm to count the very single bar in vault to make sure they are all there.

- There is more than $4 trillion invested in ETFs in the U.S.

- The world of ETFs can get pretty weird. Like: the global X millennial thematic ETFs and the health shares dermatology and wound care ETFs.

Key takeaways

- These are similar to mutual funds but they can be traded throughout the day.

- Most ETFs are index funds, meaning they track the performance of an index, such as the S&P 500.

- Some ETFs are actively managed i.e, they try to beat the Market.

- ETFs are now becoming worldly popular as now investors are moving their money into indexed funds

You can’t spell “exchange-traded funds” without fun!* — Wealth groww

*Definitions of fun may vary.