529 plan

Higher Ed, Higher Returns

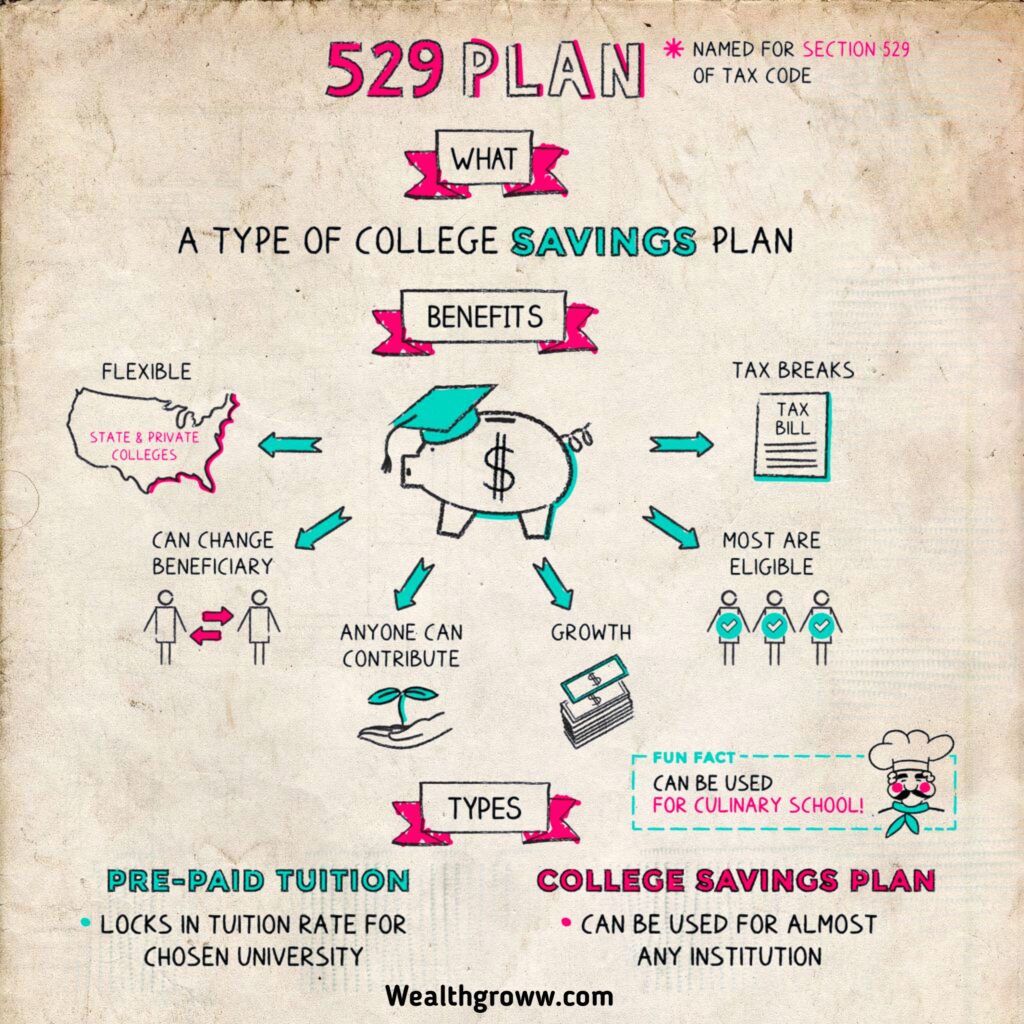

529 plan is a state government or education institution sponsored tax advantaged college saving account. The plans are similar to 401(k)s but for college funds. (The name is coming from that section of tax code which authorizes by accounts)

Types

There are two types of 529 plans:

- Via savings you can build up assets which can be used by almost any U.S. college

- Prepaid tuition plans enable parents to pay current tuition rates for their child’s future education, though they may restrict the choice of schools the child can attend.

Basically savings plans which are more flexible are mostly more popular.

- Tax breaks – in a 529 account your money can grow tax free and even it can be withdrawn tax free as far as you uses funds for qualifying expenses. There can be possibility of getting state tax deduction on contributions depending on your call on state’s plan and the state you live in.

- Potential growth – there are a lot of investment options in a 529 plan to boost your money growth.

- There are no limitations on who can contribute—Grandma’s birthday check can be deposited directly into the 529 plan.

- There are minimal restrictions on eligibility—Even high-income families are eligible to utilize the plans.

- Flexibility—You can invest in any state’s 529 program. And funds from any state’s plan can be used at any of more than 6,000 schools.

- Option to switch beneficiaries—In the event that a child or another beneficiary does not pursue college, you have the flexibility to change the beneficiary to anyone else, including yourself.

How to start

Anyone, whether it be a parent, grandparent, sibling, distant relative, or kind neighbor, has the ability to open a 529 account. You can even open one for yourself. Here’s how:

Learn about your state’s 529 plan

↓

Contrast your state’s plan with the plans of other states that are accessible to nonresidents.

↓

Select a plan and establish an account (online or via mail).

↓

Pick your investments

↓

Make your first deposit

There’s a tendency in last two steps to flip flop depending on your way of choosing plan. Some don’t have idea to where put the money once they get it, and in other plans they urge your initial deposit even before letting you choose investments.

After creating an account, you have the option to schedule automatic recurring deposits or make additional contributions manually whenever funds are available.

In your plan you can also deviate the money you hold but can do only twice a year.

- What are the plan’s tax perks?

- What fees does the plan charge and when?

- What investment options are available?

- Is there matching grants or other benefits from plan?

- Are there minimum or maximum contribution limits?

Conclusion

529 plan can be key way to save in college. There are numerous options to consider, many of which offer tax benefits and other advantages.

Fun facts

- Through 529 assets you can pay for vocational school which includes culinary, message therapy schools and acting ( but it shouldn’t be a clown college).

- You can also use the assets at a handful of schools abroad, including for a destination education at some schools in the Cayman Islands, St. Maarten, and St. John.

- It’s true that parents invest more in boys education rather than girls.

- 529 plans even will help families to save for college.

- The more popular i e, 529 Savings accounts will be like a 401(k) for college.

- 529 tuition plan will be workable for tuition related expenses for children’s.

- Every 529 plans include tax benefits and incentives with its own contribution rules and several investment options.

While the road to college may not be lined with gold, having a 529 plan can provide tax breaks along the way. — wealthgroww